3 Easy Ways To Lower Your Property Agency Commission

Buying or renting your new home is an exciting time. While you may be focused on the location, design of the house, and the monthly maintenance charges, try not to forget the commission fees you have to pay the agency. In Singapore, the average commission costs range from 0-2% depending on the type of flat and whether you are renting or buying. For instance, HDB flats might charge buyers 1% in commission, while private properties might have no additional commission charges. While these fees seem small, they could amount to thousands of dollars. Below, we listed some things to keep in mind to help you pay the least amount in commission when you are buying or renting real estate.

Know the Charges You Might Have To Pay

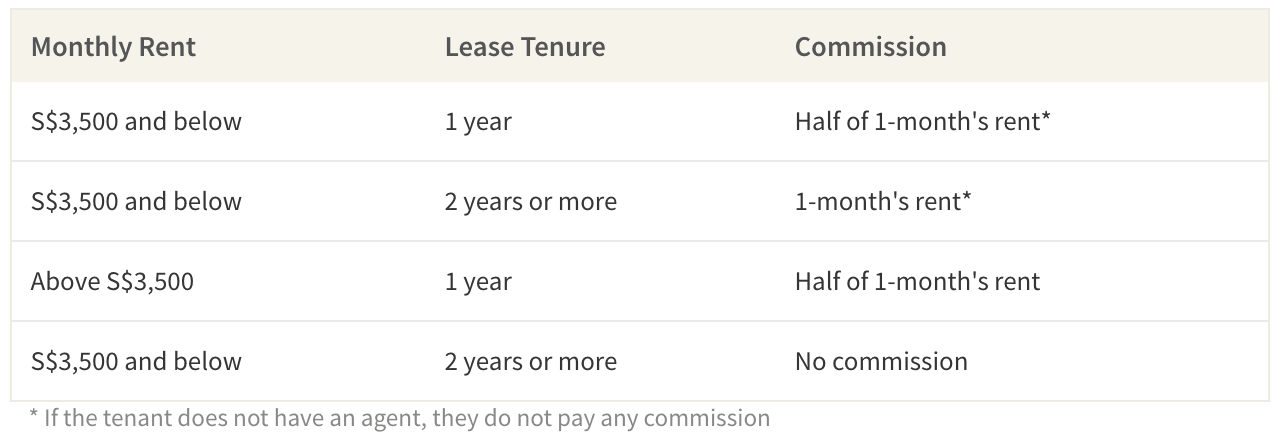

While there is no standard commission rate, there are rules one should follow when accepting a fair price. For instance, if your monthly rent is less than S$3,500, and you will only be there for a year, expect to pay about half of your monthly rent in commission for acquiring the flat. If your rent is S$3,500 or less and you will be renting the home for two years, you may have to pay a month's worth of rent. If in both cases you don't have an agent, then you may not have to pay any commission. The burden will fall on the landlord to pay the commission fees for the agency.

Average Commission Charges for Renting a Property

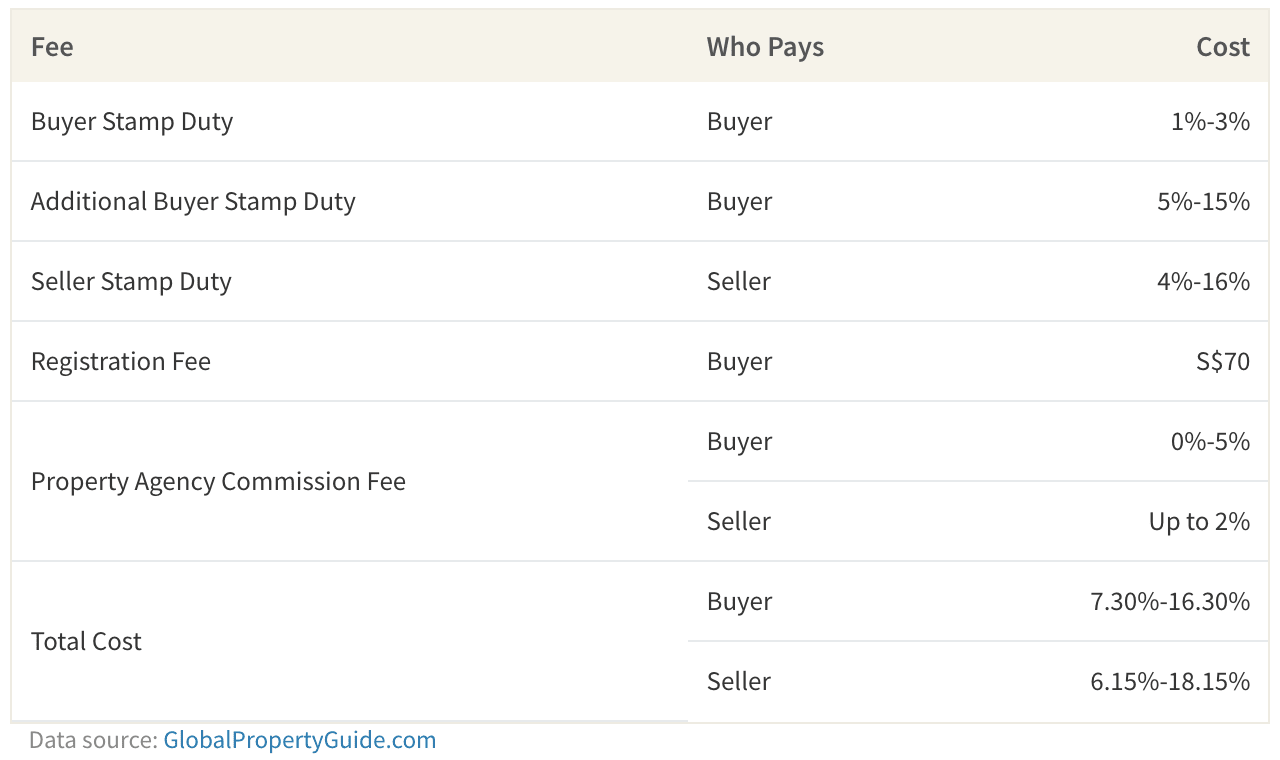

Buyers might also have to pay a property agency fee. In Singapore, the commission fee for buying an HDB resale flat is usually 1%. Alternatively, if you are buying a private property that is either non-landed (ie, condo) or landed, you will probably not have to pay a commission fee.

Compare Agencies To Get the Best Price

One way to reduce the amount you will have to pay is by comparing agency fees. If you can't find anything online, try asking a few providers about their commission rates for a flat in your budget range. Every percent increase in charges makes a big difference. For example, if you are buying a flat for S$250,000 and one agency charges 2% whereas the other charges 4%, the higher-cost agency is charging you an extra S$5,000 in commission. Unless their services are worth S$5,000, it's best to use the more affordable agency. Moreover, knowing the agency's competitor rates could even be used as leverage if you decide to negotiate with an agency.

Negotiate Fees

Another way to lower your commission costs is by negotiating the fees. As mentioned earlier, if you have found other agencies that offer similar services at lower rates, you could use that as leverage to pursue the agency you prefer. Additionally, if you're selling your property in order to buy a new one, you can use that as leverage to get a lower commission fee on each service. Also, if you are a bit more timid about negotiating prices, try using a mediator to assist with the process.

Other Fees to Consider

You should also enquire about the Goods and Service Tax (GST), as it may or may not be included in your negotiated commission fee. However, keep in mind that only GST-registered agents are allowed to charge GST.

Consider Being Your Own Agent

Lastly, you can consider being your own agent if you can only find agencies that charge fees beyond your budget. Of course, this should only be done if you have legal knowledge or experience with renting or purchasing real estate in Singapore. This is because fixing paperwork mistakes could be an extra hassle you won't want to stress about when moving.

That being said, being your own agent could save you anywhere from 1%-5% on the commission fees charged, depending on how much an agency might charge for the service. However, while this could equate to thousands more in your pocket, exercise good caution before skipping out on a property agent.

Reducing Your Cost Can Help You Save in the Long-Run

Whether you're renting for the foreseeable future or getting a mortgage to buy a house, putting into practice smart money management will help you in the long run. For instance, comparing agencies, negotiating commission fees, and potentially becoming your own property agent could help you gain experience in making the most of your housing expenses.