3 Investing Tips for Millennials: Start Investing Early, Aggressively and Independently

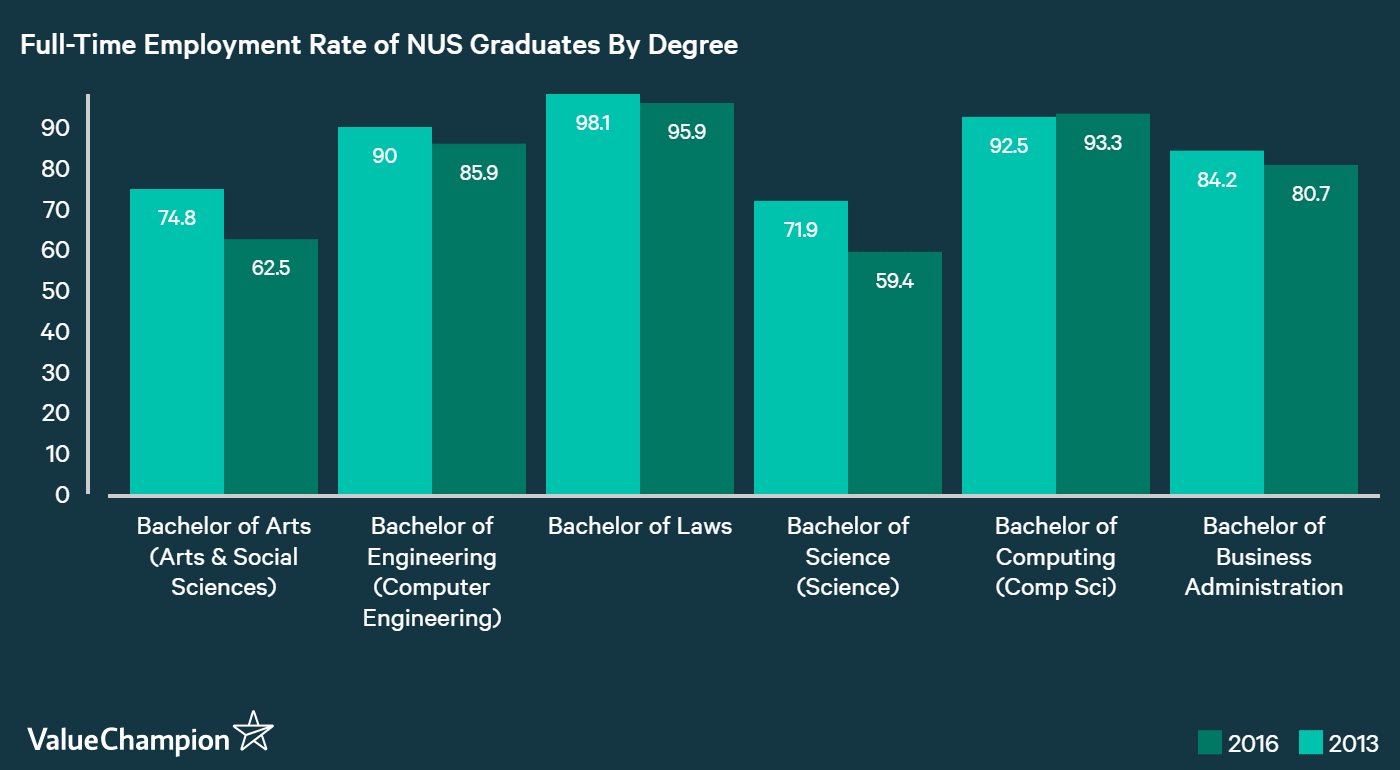

With rising difficulties in earning an income through employment, an increasing number of people are looking for sources of passive income. Millennials are no exception, as they are facing a rising unemployment rate for college graduates. For instance, full-time permanent employment rate for NUS graduates have declined meaningfully since 2013 for a number of majors. No wonder why they are very interested in ways to earn a passive income outside of the traditional career path. Here, we provide a few key points that adventurous young adults who are tipping their toes in the investing world.

Start Early, Even If It's Small

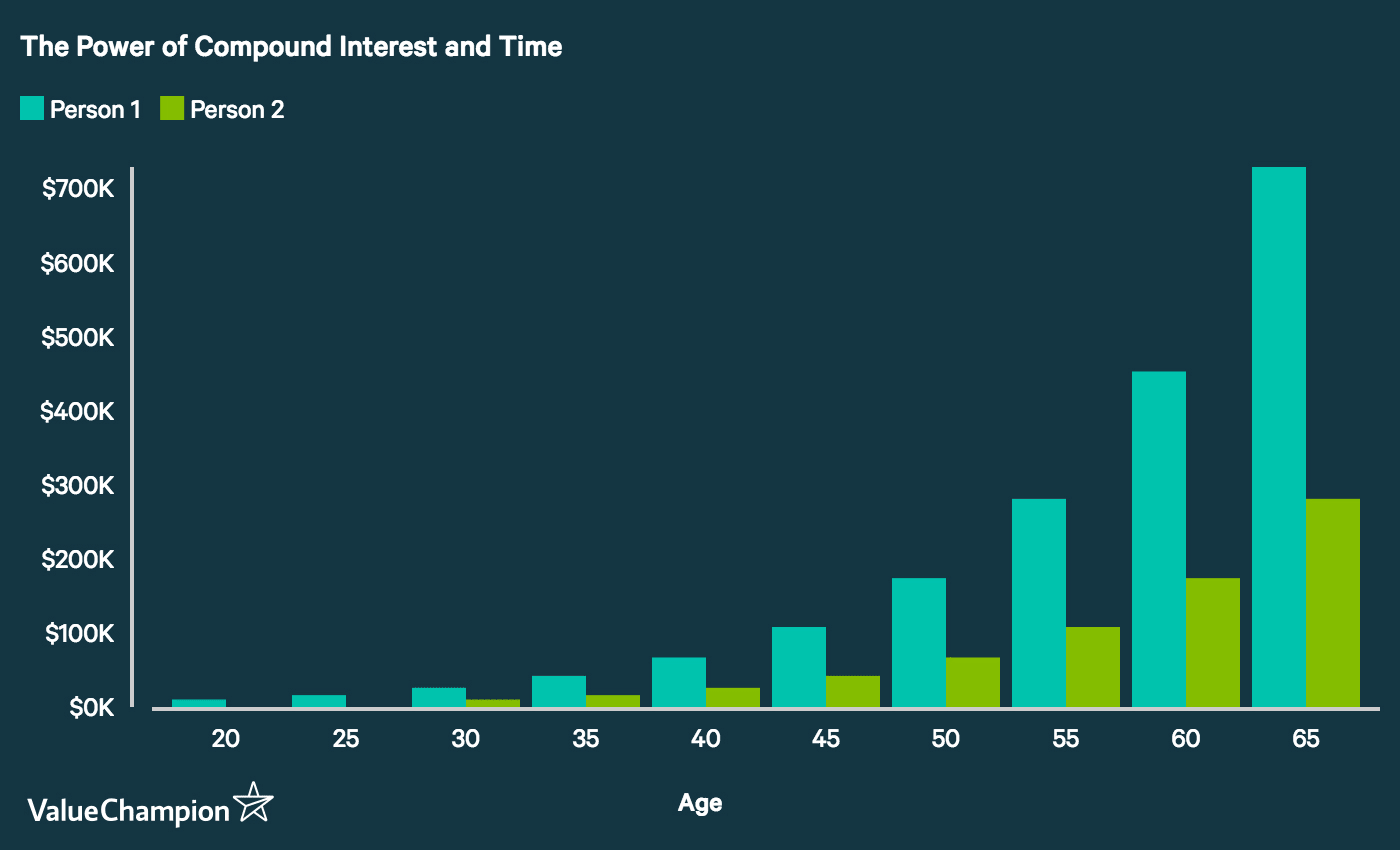

First rule of investing is that time is one of the best friends you can have in generating returns. This is because of a concept called compounding returns. Compounding interests allows your money to earn money for you over time, which can be exponential as time passes. For example, consider our example below. We compare two people who who invested $10,000 with no additional investments and earned a 10% return every year. The only difference between the two people, however, is that Person 1 began investing at age 20 and Person 2 began at age 30. By age 65, Person 1 has more than double what Person 2 has thanks to 10 extra years. It’s like what Warren Buffett said: the best thing you can do for your retirement savings is to start investing early.

Therefore, millennials in Singapore (and any where else) should start investing as early as possible, even if it's a small amount. Doing so can help you learn from small mistakes that won't ruin you financially forever, and also benefit from the long time frame over which you can compound your wealth.

This point is especially important given the lack of capital gains tax in Singapore. Unlike your normal income, the gains you get from investing is not taxable in Singapore. Therefore, you can trade all you want and benefit from each and every dollar you earn on your stocks, options and bonds.

Invest Aggressively

Contrary to the common belief that investing conservatively is the best way to increase wealth, we actually believe young investors should be investing aggressively. This means that they should be exploring international markets to find great investments, and also that they should be employing leverage aggressively to boost their returns. This second concept is worth expanding on.

Two scholars at Yale published a study that concluded that "by employing leverage to gain more exposure to stocks when young, individuals can achieve better diversification across time." Essentially, what they mean is that, because most people only have a lot of money invested when they are old, they are actually heavily underinvested when they are young. Most people don't have the long run, and therefore not a lot of stocks. However, it's better for any investor to be exposed to the stock market for a long time, since short exposures can make one vulnerable to years like 2008. Therefore, it actually is advisable to borrow to invest in stocks when they are young and only have a few thousand dollars in the market.

There are a few ways that a millennial investor in Singapore can achieve this: options and CFDs. Both offer ways for investors to make more than they otherwise would from a pure stock play, though they also come with some possible downsides. If you are interested in how to use leverage smartly, you can read our guide here.

Don't Rely On Traditional Financial Advisors

Second rule of investing is that you should always buy only what you know. This means you have to understand what an investment is truly worth. Instead of asking questions like "will Facebook's stock go up in the next month or so?," you should be asking questions like "how does Facebook make money," "how defensible is its income stream if a competitor tries to take away its market share?" and "what should Facebook be ultimately worth in the long run?" You should try to learn about the stocks, ETFs and bonds that you are purchasing, and make calculated decisions to purchase based on a sound logic around what you are paying, how much you can earn if you are right, and how much you can lose if you are wrong. "Do-It-Yourself" is a mantra that doesn't just apply to home improvement projects anymore.

Of course, this can be a rather steep learning curve for most people, though it's one well worth climbing. Instead, many might be tempted to blindly follow recommendations offered by traditional financial advisors who sell different funds and stocks to them. However, this is usually not a good idea. Financial advisors make money by selling you things, not by helping you make money. They also tend to come with a rather high commission rate. Instead, for novice investors who aren't yet comfortable with picking their own stocks can look for robo advisors that provide a decent amount of diversification with very low fees while they learn how to invest.

Parting Thoughts

At the end of the day, the goal of investing is to make money. And to do so, the most important thing to do is pick the right investments. Therefore, it is always a good idea to start making the effort to learn how to invest well when you still have a lot of time left. Starting early is an efficient way of providing both an opportunity learn through small mistakes and a chance to let time create wealth for you.