4 Home Insurance Mistakes That Will Cost You

Your home will be your most important asset. Not only is it a place where you will spend a large portion of your life, but it also contains all of your prized possessions. For people who have diligently renovated their new flats, their home also contains many months of blood, sweat and tears. This is why it's so important to make sure your home is fully protected. However, since home contents insurance is an optional purchase, people may not look into policies as diligently as they would for other forms of insurance. Unfortunately, this can lead to losses of thousands of dollars as well as thousands of dollars in out-of-pocket costs. To help homeowners unnecessary costs, we broke down 4 major mistakes you can make with your home insurance policy.

1. Underinsuring

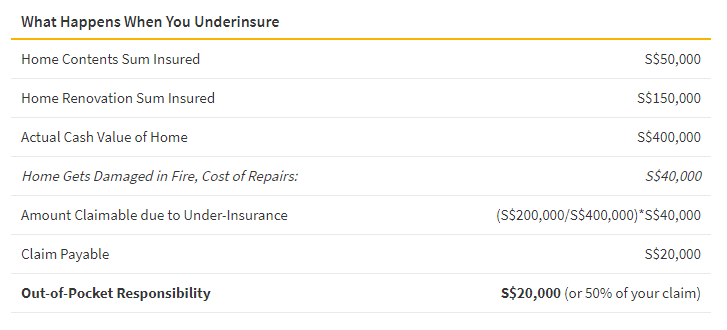

One of the costliest mistakes you can make when it comes to your home contents insurance is under-insuring. Underinsuring occurs when the sum insured is less than the actual cost of the contents or renovations. If you are underinsured and you need to file a claim, you'll end up paying a fraction out of pocket. For instance, if you insure your property for S$300,000 and the actual value of your home is S$500,000, your insurer will pay out on a prorated rate of 60%. When it will be time to make a claim—regardless of what it's for—your insurer will cover 60% of the cost and you will be responsible for paying the other 40% out-of-pocket. Most of the time, we may not even realise we are under-insured until it comes time to file your claim.

To avoid underinsuring your property, you have to calculate the value of your renovations and contents as accurately as possible. If you recently moved and you used a credit card for your home purchases, you can find the cost of all the items purchased for your new home in your statements. You should also keep all your contractor invoices. You can organise these expenses in a spreadsheet and update it frequently to ensure your coverage needs are being met. If you are missing receipts for an item, you should try to find the cost of it online and keep the photo and link for reference purposes. If you don't yet have fire insurance or you need building coverage, you can calculate the building costs of your home by calculating the square footage and the unit cost per square meter to get the estimated reconstruction cost. Then, you should add the value of building fixtures and fittings along with the cost of professional fees (around 10% of total), demolition and debris removal (around 5% of total) and taxes for the total cost.

2. Not Telling Your Insurance About Changes to Your Home

You decided to completely renovate your bathroom, or maybe you decided to buy that S$5,000 art investment piece you've had your eye on. Whatever the case may be, any significant changes to your home should be reported to your insurer. This ties to the concept of under/over insuring. When you are adding something of value to your home, you should increase your insurance policy by that value. This ensures that if a catastrophic event like a fire happens, you will be able to claim for the full amount of your belongings (including that new work of art). The same goes for if you decide to reduce your home contents. If you manage to get rid of a lot of unused/unwanted furniture, then you may end up needing less contents coverage and will end up paying a smaller premium.

3. Not Paying Mind to Policy Exclusions

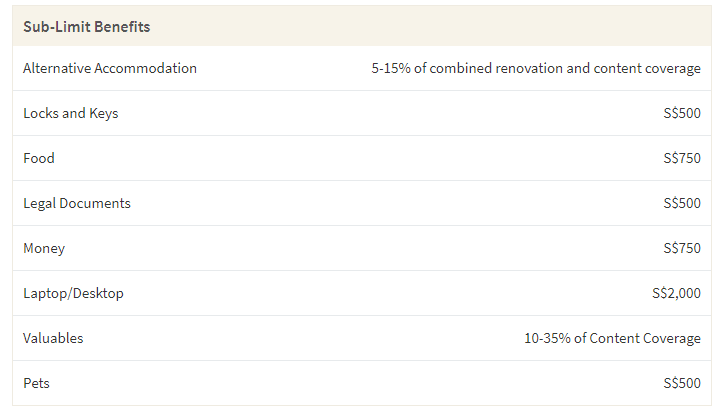

It's easy to assume that all types of damages will be claimable on your home insurance policy. Unfortunately, that's not the case. Depending on the insurer, you may not be able to claim for a variety of reasons you may have initially thought you'd be able to. For instance, some insurers won't let you claim for theft unless force was used to enter your property. If a thief was able to get into your home without leaving a trace (or you accidentally left your door unlocked), you won't be able to file a claim. Another exclusion you may not be aware of? If you are moving and professional packers damage brittle items or china/earthenware, you won't be able to claim for those damages either. This isn't applicable to all insurers, but it's why it pays to be diligent in reviewing the policy document before you purchase a home insurance plan. Lastly, other exclusions may be in the form of sub-limits. While you may have S$50,000 of contents coverage, you may actually only be able to claim S$1,000 for jewelry or S$5,000 for artwork. To avoid losing money by not being able to claim for your valuables, we suggest looking for policies that have generous sub-limits.

Average Contents Sub-Limits in Home Insurance

4. Thinking You Can Go Without Home Contents Insurance

Arguably, the most important mistake on this list is not having home contents insurance in the first place. While HDB and condo flats are covered by the management company's fire insurance, which covers water, smoke and fire damage suffered to interior and exterior structures of your flat, your home contents won't be covered. This means all of the treasured items in your home, along with any renovations you've done will be unrecoverable if something a force majeure event like a flood occurred.

If you're foregoing home insurance because it seems too expensive, then it may surprise you to know that you can find high value annual policies for under S$145 per year for a 4-room flat. That amounts to under S$15 per month. For this amount, you can get around S$54,000 of home contents coverage and S$122,000 of renovation coverage—80-144% more coverage than the minimum coverage a 4-room flat requires.

Pay A Little to Save A Lot

No one wants to have more monthly bills. But at the end of the day, it pays to invest a little bit in protection rather than hoping your home won't be a statistic. Home insurance can bring peace of mind in addition to invaluable protection, since it also provides other useful services like emergency home assistance, alternative accommodation benefits if your home is damaged and you need to stay in a hotel and can even pay for lock or key replacement. Since every home insurance plan is different, you should compare plans across different insurers. For instance, some insurers like Etiqa and Income are better for budget HDB flat owners due to their low prices, while insurers like MSIG can be a great option for private homeowners with expensive belongings due to its above average valuables and contents coverage.