4 Tools to Teach Your Teen Financial Discipline

As your child matures and prepares to face the world as an adult, it's essential to support the development of strong financial responsibility. The tools and techniques discussed below will help you guide your teen to a better understanding of how to manage their money.

Part Time Job: Understanding the Value of Money

"Free money"–like an allowance received from family, with no strings attached–can feel like just that: free. While some pocket money may be necessary for transport and food in school, receiving excess amounts (such as for spend on shopping and entertainment) may ultimately cloud your teen's perception of money's worth. To help your child understand the hard work behind each dollar, you may want to encourage them to take on a part-time job.

As of 2017, only 14% of teens between 15–19 years old were engaged in the labour force. However, those in this age group who'd finished secondary school earned approximately S$703/month. Considering the average Singaporean household spends just S$200/month on shopping, it's safe to say such earnings would cover the social needs of a teen, all while exposing them to the "true cost" of their favorite items.

Independent Budgeting: Balancing Earnings & Spending

If your teen's taken on a part-time job, they may now have the added freedom of controlling their own discretionary spending. While it may seem like common sense to an adult, it's worth sitting down with your child to discuss basic budgeting. Earning money won't suddenly free them to buy everything they want; they'll need to balance their impulses with more enduring goals.

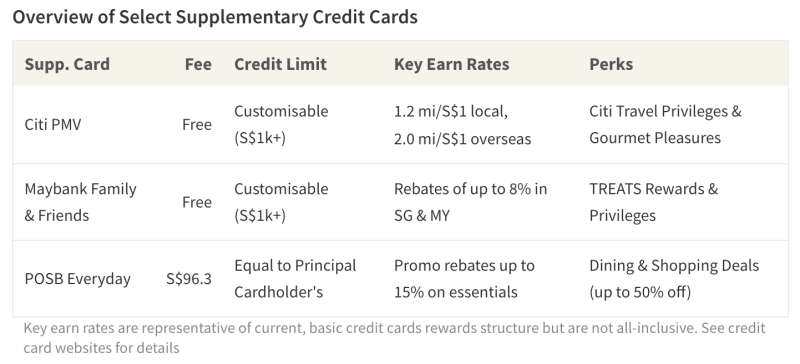

At this point, you may want to consider starting your teen out with a supplementary credit card (which is typically available through your own credit card). Such cards are usually free or have very low annual fees, and the principal cardholder–you–can often set a credit limit and monitor all account statements. Furthermore, your teen's spend will earn cashback or miles at the same rate as your own card, and rewards will be credited back to your own account. While this might not seem fair to your teen, they'll still have access to perks like dining and lifestyle discounts–all while learning to budget and use a credit card responsibly.

"Hands Off" Saving: Fostering Patience with Long-Term Accounts

Even if your child is working and spending responsibly with a credit card, it's still essential to take a step further and teach them financial patience and restraint. If they are earning income, suggest setting some of that money aside in either a fixed deposit or savings account; otherwise, consider investing on their behalf and helping them track growth from interest.

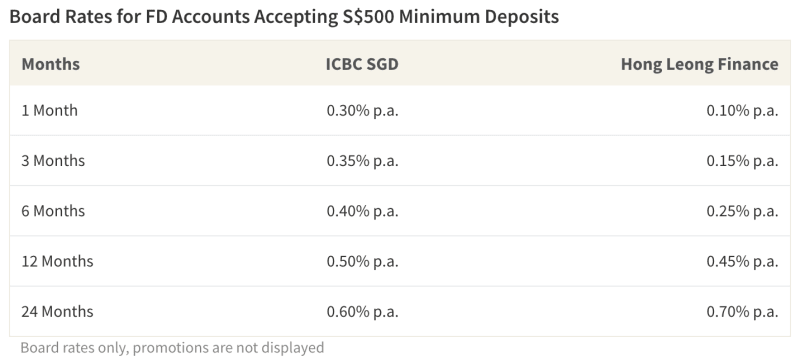

For reference, fixed deposits are risk and maintenance-free savings tools where consumers deposit a set amount and earn at a set interest rate for a specified period of time. Some banks accept deposits of as little as S$500, and in many cases, 15+ year olds are eligible to apply. Removing funds before the end of the established tenure forfeits any interest earned–therein promoting patience on your teen's behalf.

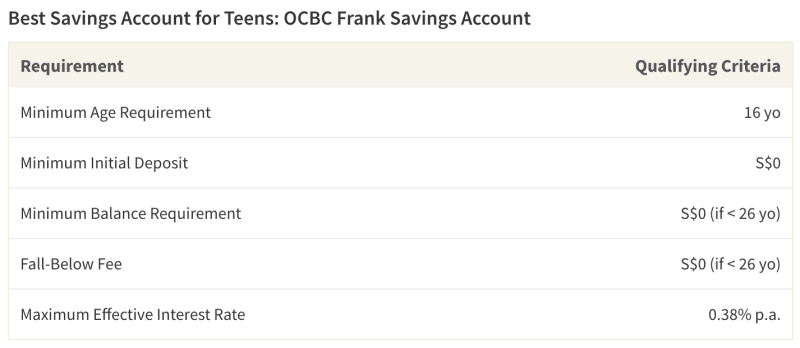

Perhaps such a minimum deposit size is out of reach, or maybe you and your teen feel comfortable with a more involved account. In this case, opening a savings account is a great training option. Some accounts, like OCBC Frank Savings Account, do not have a minimum initial deposit requirement. Savings accounts are usually flexible, allowing for withdrawals as needed. However, most accounts have a minimum balance requirement, and falling short incurs a fee. Overall, a savings account may be a more advanced option for teens who can maintain savings consistently.

Family Meetings: Learning & Preparing for the "Real World"

Finally, consider holding weekly or monthly family meetings to discuss your household's finances. Working to earn money, learning to spend responsibly and saving can all contribute to your teen's growth. However, the best way to prepare them for the "real world" is to provide exposure to larger issues, like paying bills or taking out a loan. It's far better to explain these processes in context to your teen now, rather than have them face such issues later without any experience. This doesn't mean you have to share everything with your child; prioritise discussions that are less confidential and that would be meaningful to their growth.