How to Analyse Crowdfunding Loans as an Investor

Crowdfunding loans are a great opportunity for SMEs and individual investors alike. These loans allow SMEs to access financing that may otherwise be out of reach, which is provided by investors that are able to receive competitive returns. Because loans are investments, individuals must carefully consider the opportunities available before contributing to these campaigns. Here, we discuss factors for investors to consider when choosing a specific crowdlending opportunity.

Calculate and Analyze Expected Returns

Typically, the interest rate of each crowdfunding campaign is determined by the borrower, by investors in an auction or by the crowdfunding platform itself. Investors should compare interest rates across investment opportunities in order to evaluate expected returns. Typically, business loans on crowdfunding platforms offer annualised returns of 12 - 25%. While a higher interest rate means a better return, it also represents a riskier investment. Make sure that you conduct due diligence that makes you confident that the SME can repay your loan, as we describe in more detail below.

Assess Ability to Repay

When contributing to crowdfunded loans, investors should be assessing the ability of each company to repay its loans, rather than their long-term potential for growth. For example, while a potentially high-growth tech startup might grow exponentially in the long-term, this same business may not currently have the cash flow to repay a loan in the short-term. If this were to occur, the firm would default and you may lose a portion or the entirety of your investment. Individuals that invest in crowdfunded business loans should primarily care whether or not a business will repay their loan. To that end, there are are a few factors to consider when determining whether or not a business will repay their loan.

Borrowing History

In the same way that a credit score considers an individuals borrowing history, you as an investor should take into account an SME's borrowing history. SMEs that have successfully repaid a loan from the crowdfunding platform could be safer investment opportunities since they show a higher probability of of repayment compared to untested firms with no track record.

Financial Profile

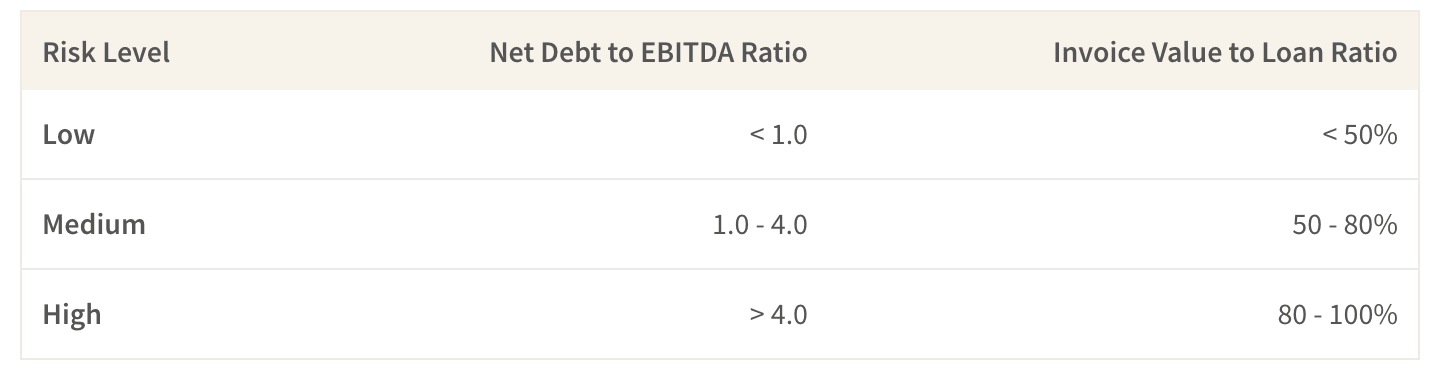

To the extent that financials are disclosed, investors should analyse the available financial information of each SME. For example, investors should consider the amount of debt that the business currently holds, whether or not its costs exceed its revenues, and if it has a positive net cash flow. Specifically, investors might consider calculating the company's leverage ratios to understand how much debt it holds and the comparative risk of non-repayment of each SME. For business loans, it can be helpful to consider the net debt to EBITDA ratio. This ratio is calculated by subtracting cash from total debt and dividing the result by earnings before interest, taxes, depreciation and amortization (EBITDA). Generally, investors should be wary of SMEs with net debt to EBITDA ratios above 4. For invoice financing, investors should prefer financing amounts that represent a lower amount of the invoice value. This indicates less risk of non-repayment.

These factors paint a picture of the business's financial operations and help indicate whether or not the it will have difficulty repaying their loans. Additionally, some platforms provide their own analysis and scoring for each lending opportunity that describes the borrower's likelihood of repayment.

Borrowing Purpose

Finally, it is important to consider why the SME is seeking to borrow funds and how this impacts their likelihood of repayment. Typically, loans with specific uses provide lenders with more assurance of repayment, as the they are given details about the use of the financing. Some examples of specific borrowing purposes include working capital, asset purchase and expansion. The more you able to cull from the SME's campaign page regarding the purpose of the financing, the more you will understand about the business's plan and its ability to repay its loan. However, an SME that needs a loan to repay another loan could represent a high level of risk for the investor.

Understand Fees in Relation to Investment Amount and Expected Returns

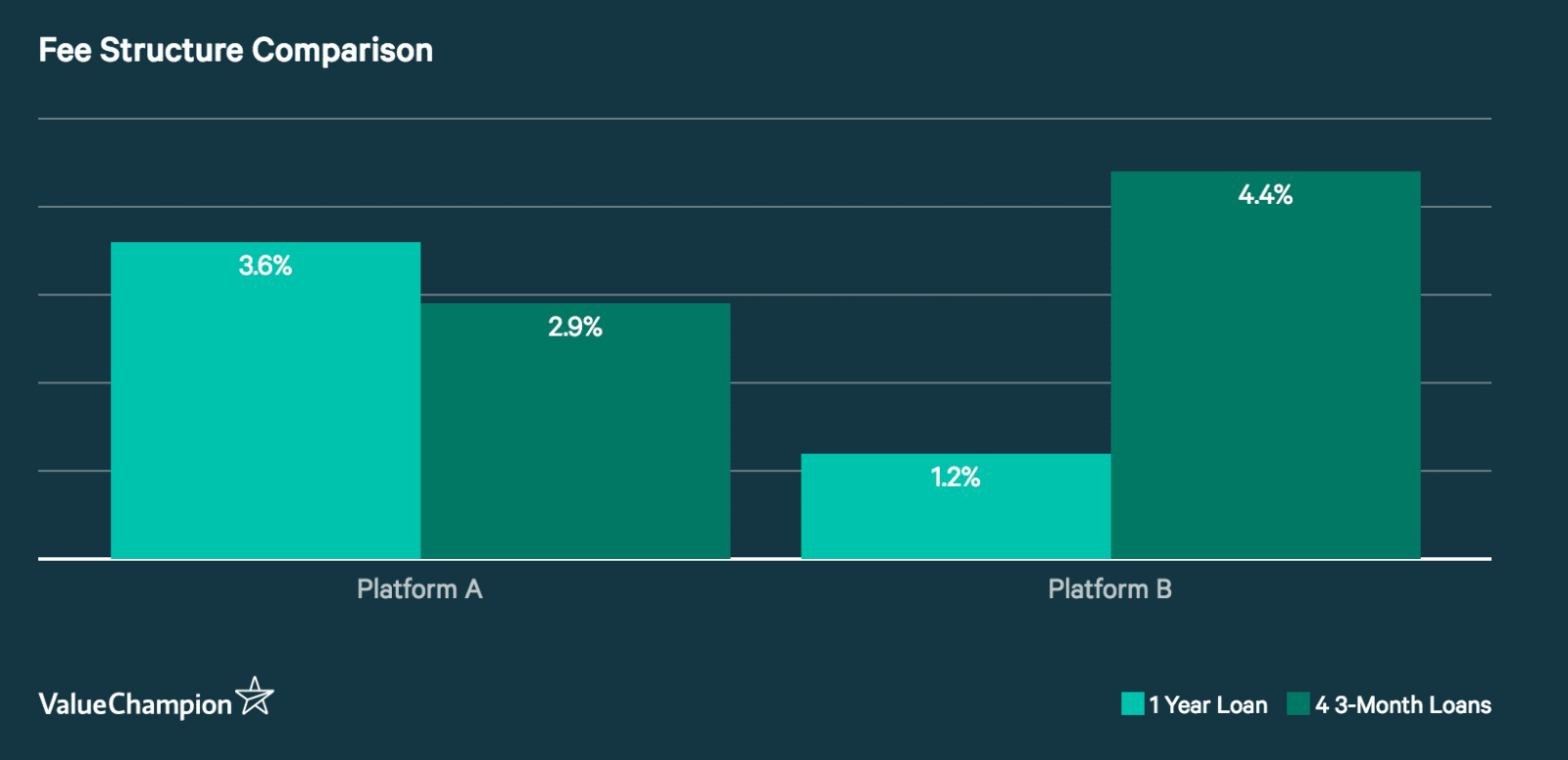

Because each platform's fees impact your net returns, it is important to consider the platform's fee structure when choosing your investments. Depending on the platform that you use to invest, it may be more strategic to invest in loans of different durations. For example, a platform that charges a small fee on the total amount amount repaid (loan principal plus interest) may be costlier for short-term loans, than a platform that charges based on the amount of interest received.

For example, let's assume you invest S$1,000 in a one-year loan that returns an annualised rate of 20%. Through Platform A that charges a fee 18% of interest earned, you should expect to pay 3.6% of your initial investment in fees. This is more than you would have paid through Platform B that charges 1% of total repayment received (1.2%). However, given the same investment and return rates, you would have paid less in fees had you invested in four consecutive three month loans with Platform A (2.9%) than with Platform B (4.4%). The point being, it is important to calculate your expected returns and fees of each potential investment before contributing to a crowdfunding campaign.

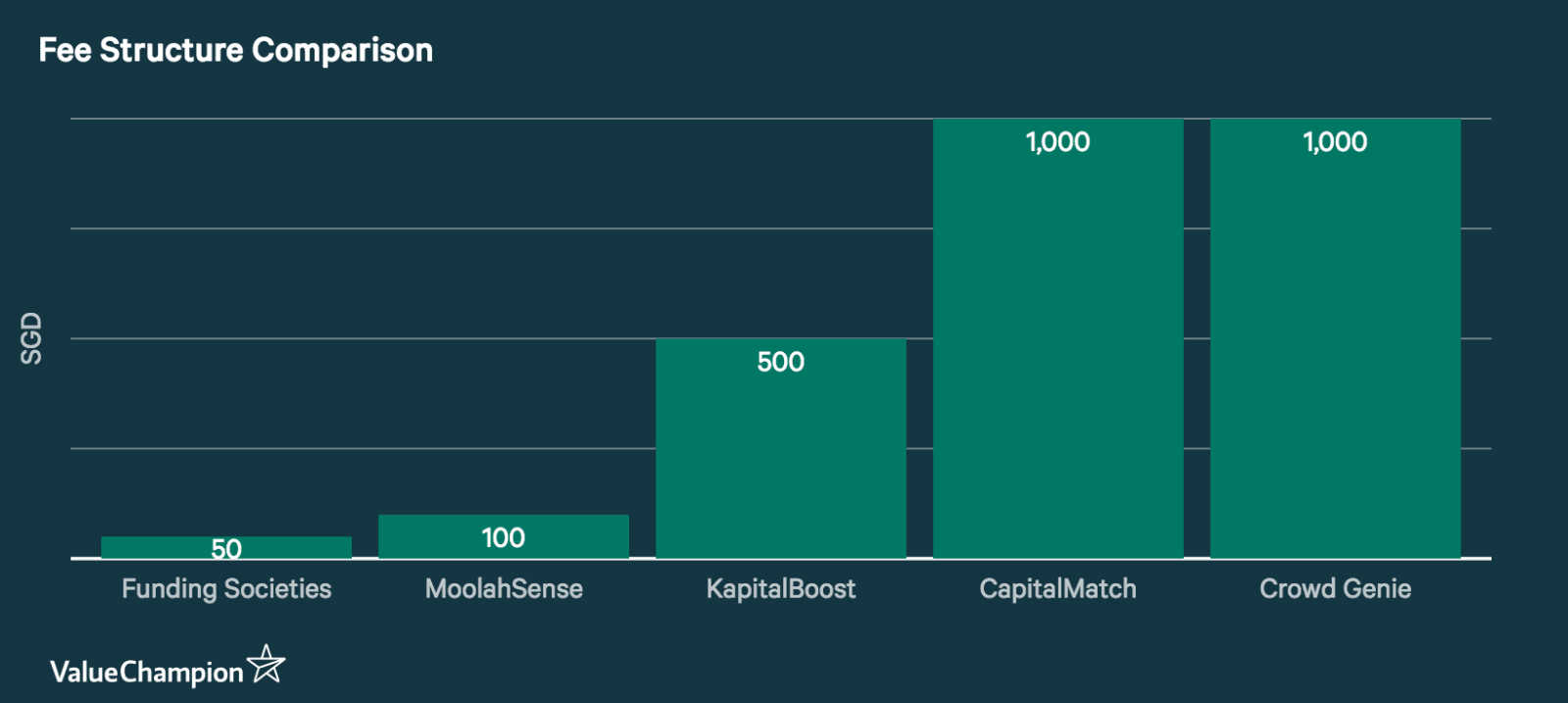

Consider Investment Requirements

Finally, investors should check the required and maximum contributions. For example, some loans require S$1,000 per loan campaign, while others only require S$50. This is important as it will determine if individuals have enough free capital to invest in the campaign of their choice and diversify their profile.