Investing in Founder Led Companies: How to Do It Properly

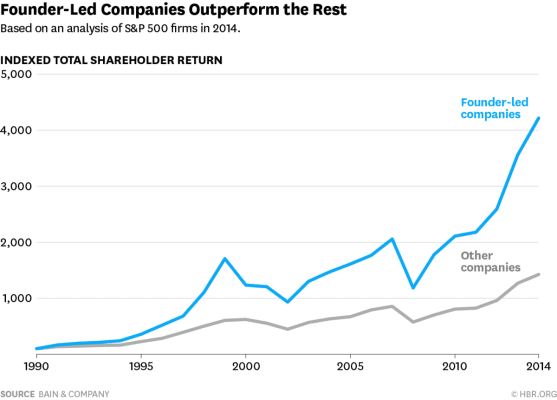

A very popular and well-respected investment strategy is to invest in stocks of companies that are still led by their founders. According to a study conducted by Bain & Company, the stocks of founder-led companies outperformed those of other companies by 3.1x over the course of 15 years.

However, it is a misleading to make a blanket statement that all founder led companies are better than companies that are led by professional CEOs. Rather, some companies that were run by their founding CEOs have actually done quite terribly as well. Here, we discuss some of the filters investors can apply to filter out the winners and losers among these so called attractive investments.

Look for founders who still control their companies

One critical reason why founder led companies excel is that founders are able to make difficult decisions that may be painful for the short-term, but are good for the long term. For example, when Netflix made its famous pivot from DVD rental service into a online streaming service, its stock declined by about 80% in less than a year. Obviously, this was an extremely important decision that created a revolutionary product, changed people's lives and resulted in a 200x increase in its stock price. However, it would have been an almost impossible for the company to have made such a transition had Reed Hastings didn't effectively control his own company.

Whenever companies face a major crossroads, founders have been known to make difficult but necessary decisions better than short-term professional CEOs. Similar things can be said about many other successful companies that have gone through difficult transitions, like Facebook when it decided to be a mobile-first company in 2012 and Amazon while it produced zero profits for a decade. Founders don't necessarily have to be retain more than 50% of the votes in order to control their companies. Instead, they could also just be wholly supported by their board of directors and the management teams, or be one of the biggest shareholder by a big margin.

Look for founders with reliable track records and continuity in their roles

On the other hand, not all founders who have control have enjoyed continued success. In some cases, some of these founders lacked the depth of experience and expertise to lead their companies through the tumultuous growth path they were on. For example, Groupon is a famous example of a company whose stock plummeted under a young founding CEO. In other cases, lack of continuity in the C-suite has also resulted in bad performance; Twitter is a prime example of this, with its top spot changing hands among co-founders and a hired CEO 3 times in 10 years. Even experienced and skilled CEOs have failed as their role changed and they were no longer doing what they were good at, which is commonly described as "product CEO paradox".

Therefore, it's important to find founder-led companies where founders are still very much involved in what they are good at. They don't necessarily have to be product geniuses like Steve Jobs. For example, John Malone, the chairman of Liberty Conglomerate who is famous for having built the cable industry in the USA, has always been focused on deal making and efficient capital allocation, while leaving operations to his partners.

Don't ignore the business model

Lastly, it's important to conduct a thorough due-diligence research process on these founder-led companies. In fact, the fact that certain companies are run by smart and able founders is almost irrelevant if the business itself is doomed to fail from the start. There are many examples of this phenomenon, one of the most famous being Blackberry. Its product-oriented CEO is famous for having stubbornly pushed Blackberry's keyboards as iPhones and Androids destroyed its business.

Companies aren't going to be great investments just because they are led by smart and able founders who retained control over their businesses. Basing your investment decision solely on this factor would be equivalent to acquiring a championship football team to compete in any sports events. It's possible that they could have some success given their athletic prowess, but they could also have spectacular failures if they are playing in some events that require completely different set of skills. Therefore, it's very important to actually research and understand how the business is situated relative to its competition and the overall industry. When all of the stars align, you will be more likely to find great investment opportunities (given the right price!).