Singapore’s financial institutions are very active in terms of introducing new products to lure customers away from their competitors. Banks have been introducing new and improved rewards credit cards to increase their market shares.

Many of these new products offer great value propositions to consumers. However, consumers shouldn’t blindly apply for all of the newest additions to the market just because they sound attractive. In fact, going from card to card can actually be a harmful exercise if you don’t do it carefully.

Here, we discuss a few things you should consider before applying for the newest credit cards in the market.

Related: What Are the Risks of Credit Card Churning?

What Card You Get Depends on Your Spending Pattern, Not New Features or Sign-On Bonuses

When considering whether you should apply for that newest card in the market, you should first consider how it fits into your spending pattern.

You should have a rough idea of how much money you tend to spend per month, and if your expenditure is concentrated in any particular area like dining or shopping. These two factors impact how much you can benefit from a particular card much more than the sign-on bonuses.

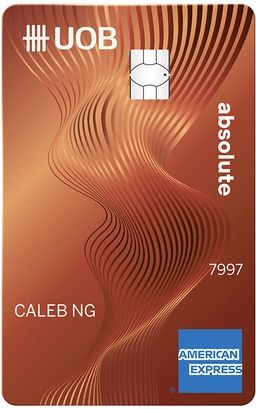

Let’s consider the HSBC Advance Credit Card. It is a great option for high spenders with the potential to earn 2.5% cashback when you spend more than S$2,000 a month. If we compare this to the UOB Absolute Cashback Card, which only gives you 1.5% cashback on your spending, it may seem like a no brainer to go with the HSBC Advance Credit Card over the UOB Absolute Cashback Card.

HSBC Advance Credit Card

People with high expenses will appreciate the HSBC Advance Credit Card cashback potential.

Pros

- Great fit for budgets between S$2,000 and S$8,000/month

- Easy, low-maintenance cashback

Cons

- Lacks travel perks

- Doesn't fit highly specialised spend behaviors

However, with the HSBC Advance Credit Card, the cashback you can earn is capped at S$70 per month. Meanwhile, the cashback earned on the UOB Absolute Cashback Card allows you to earn unlimited cashback.

Hence, while the flat cashback rate of the HSBC Advance Credit Card may seem more enticing, the true value of the credit card to you as a consumer is still highly dependent on your spending habits.

If you spend between S$2,000 to S$4,100 a month, you are better off utilising the HSBC Advance credit card and maximising the S$70 cashback rewards. If you spend more than S$4,100 a month, you are better off utilising the UOB Absolute Card and earning unlimited cashback.

UOB Absolute Cashback Card

UOB Absolute Cashback gives you 1.7% limitless cashback on all categories, no limits, no minimums and no caps.

Pros

- Unlimited cashback

- No min, caps or exclusions

- American Express Card privileges

Cons

- Low cashback rate for smaller budgets

- Annual fee

How Much Do Sign-On Bonuses Matter?

One argument against our case could be that sign-on bonuses can make such a calculation less relevant. Why not just sign up for a new card, collect the bonus cash rebate or miles, and cancel the card? There are two main reasons why such a thought process can be misguided.

First, often, these bonuses aren’t big enough to offset the potential opportunity cost that they create. For instance, our example pictured above implies a difference of S$360 in total rebate earned over 2 years between the two credit cards if you spend S$5,000 a month. A typical cash bonus of S$180 isn’t big enough to offset this difference.

Secondly, many promotional bonuses entail certain level of minimum spending requirements. If you stretch your budget just to satisfy these requirements and earn sign-up bonuses, you can be troubled by the overwhelming credit card debt that comes with a +25% APR.

Therefore, you should treat sign-up bonuses as what they are: a cherry on top bonus for getting something that is already great for you. They are nice addition to the value proposition of a card if the card itself fits your budget and spending pattern well. Applying for a new card just for the sake of its bonus can have some hidden costs that you can’t easily anticipate ahead of time.

Related: Guide to Credit Card Effective Interest Rates (EIR) & Annual Percentage Rates (APR)

What If Your Existing Card’s Terms And Conditions Changed?

Sometimes, the “newest” card in the market can actually be just a rebranded card that you used to have. Banks can and do change their terms and conditions time to time. But does this mean that you should just abandon the card every time it changes? The answer is no. You can use the same process we just described for assessing a new card to determine if you cancel or keep your existing card if and when its terms and conditions change. If the new set of rewards and fees work well for you, you should consider keeping it. If not, it would be wise to look for alternatives. For you to decide whether or not to keep these cards, all that matters is that their current benefit and fee structures nicely match your individual spending preferences.

If you are interested comparing your existing cards to the new cards on the market, or maybe even checking out what sign up promotions are on offer, check out our results page of the best credit cards in Singapore.

Compare The Best Credit Cards in SingaporeFind Out More

Read More:

- 3 Tips on How to Get Rid of Your Piling Personal Debt and Credit Card Balance

- How to Find the Best Rewards Credit Card

- 7 Effective Tips To Accumulate Air Miles Fast

- Real Dangers Of Credit Cards & How To Avoid Them Like A Pro

- 3 Psychological Pitfalls to Avoid When Choosing A Credit Card

Cover image source: Pexels

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group consists of PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.