Credit history is a record of an individual’s payment behaviour that reflects his or her ability to repay a loan. Credit history is one of the critical factors used in credit scoring, and is employed by lending institutions as a qualifier for new loans.

As most lenders will check your credit file to assess your creditworthiness prior to making a decision, a good credit repayment history will make it easier for you to obtain credit and to qualify for the big ticket items such as taking out a mortgage, planning a wedding, qualifying for a car loan and building up for retirement. While this might sound contradictory, the only way to build your credit history is to take on credit.

Related: 5 Foolproof Ways to Improve Your Credit Score

Here are some tips to build a positive credit history, step by step:

1. Get a Credit Card

Signing up for a credit card will be the easiest route to start building up your credit history.

Credit cards are a valuable stepping stone to measuring and tracking your credit and financial progress over time. How you charge purchases to your credit card and pay off your credit card debt every month will determine your credit standing and show how much of a credit risk you are. Paying your credit card balances in full every month helps you to maintain your credit rating and build up a good credit history. Doing so will enable you to use credit to work harder for you, rather than becoming a slave to credit.

Compare The Best Credit Cards in SingaporeFind Out More

Here are the other tips to build up a good credit history:

- Pay your bills on time: Where possible, always try to pay in full as rollover/outstanding balances will be charged at 26% p.a. Consider payment via GIRO to ensure payments are not late. Do note that default records stay on your credit report for 3 years upon full or negotiated settlement while bankruptcy data is retained for 5 years from the date of discharge from bankruptcy. It’s important to be disciplined about paying your bills as failure to do so can have long lasting effects on your credit score.

- Limit the amount of cards: More cards and higher credit limits could trick you into spending more. If you are not careful, you could end up overspending. Also, this increases the odds of not paying one of your credit bills on time. Cancel any unused cards – It is more manageable to keep track of 2 credit cards than 10. Don’t apply for lots of credit at once – This sends a signal to creditors that you are desperate for credit and are a risk to lend to which could lower your credit score.

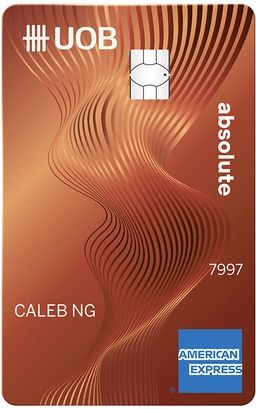

A great example for a good starter credit card is the UOB Absolute Cashback Card. With a flat 1.7% cashback on all spend, you won’t have to worry about if you are spending enough to earn rewards every month. Such a card not only lets you reap the benefits of credit card rewards while building a strong credit history, but it also does not tempt you to overspend on items you may not need in the process.

UOB Absolute Cashback Card

UOB Absolute Cashback gives you 1.7% limitless cashback on all categories, no limits, no minimums and no caps.

Pros

- Unlimited cashback

- No min, caps or exclusions

- American Express Card privileges

Cons

- Low cashback rate for smaller budgets

- Annual fee

Related: 4 Key Questions To Ask Yourself Before Signing Up For A Credit Card

2. Watch Your Spending: The Debt-to-Income Ratio

Yes, while we just told you to get credit by any means possible to start builing your credit history, you do not want to mindlessly whip out your cards to pay for everything. A rule of thumb to determine how much credit you can take on is to compare how much you owe with how much you earn. A simple calculation based on these two factors is called the Debt-to-Income ratio. Here is an example of how the Debt-to-Income ratio is calculated:

| Calculating your Debt-to-Income Ratio | |

|---|---|

| Monthly debt repayments | S$800 |

| Monthly take-home pay | S$3,200 |

| Debt-to-income ratio | S$800/S$3200 = 0.25 |

With the above monthly expenses and take-home pay, you would have a debt-to-income of 25%. It is always important to have a good understanding of your financial situation in order to meet your financial obligations. Commit to tracking every cent spent. It is only through doing so that you can identify any leaks and use your money properly. Avoid spending to your full credit limit. It is important to have some buffer in case of unforeseen emergencies. It is also important not to fall into the trap of buying on impulse just because you can place your purchase on credit. Cultivating the habit of watching your debt-to-income ratio is a great place to start to ensure that your debt load is manageable.

Related: 3 Tips on How to Get Rid of Your Piling Personal Debt and Credit Card Balance

3. Get a Copy of Your Credit Report from Credit Bureau Singapore (CBS)

A copy of your credit bureau report from CBS is the next step that you can take on your road to financial independence. It is a good habit to review your credit report semi-annually to check your credit history.

Your credit report will contain a record of your credit payment history compiled from all the financial institutions in Singapore and provide valuable insights into your financial history, knowledge and repayment behaviour. This encompasses a comprehensive assessment of your aggregate credit limits and outstanding balances under your credit cards and other facilities. Knowing your credit standing can help you become empowered to make better informed decisions for future applications of credit facilities. Only through closely monitoring your credit report will you be able to identify if your debt load is increasing unsustainably so that you can take action on it before it snowballs out of control.

4. Be Smart About Utilising Personal Loans To Improve Your Credit Score

If you find that you high-interest credit card debt is starting to get too large to manage, one good way to mitigate this is to look at other financing options to help you get out of debt.

One great way to do so is to take out a personal loan to pay down your credit card debt. As the interest on a personal loan is substantially lower than on a credit card, making use of personal loans is a great way to lower your interest burden on your debt instantly so that you can get on top of it quickly.

If you are unsure about what type of personal loan best suits your needs, loan brokers like Lendela offer the service of comparing loans across different financial institutions so that you can get a quick bird’s eye view of all the personal loan products you qualify for in one place.

Now that you know why you credit history is important and how best to grow and maintain your credit health, check out our resources on home loans, credit cards and personal loans to learn more about how these financial products can help fund your different life goals.

Compare The Best Credit Cards in SingaporeFind Out More

Read More:

- Home Loan Calculator: Find the Best Mortgage Rates

- 5 Reasons Why Your Credit Card Application was Denied

- What’s a Debt Consolidation Plan and Who Needs It?

- 5 Common Credit Mistakes That Can Affect Your Loan Application

- Benefits of Green Loans and How To Apply For Them

Cover image source: Pexels

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group consists of PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.