Top 5 Mistakes When Building Your Credit In Singapore

What Is A Credit Score and How Does It Impact Your Financial Health?

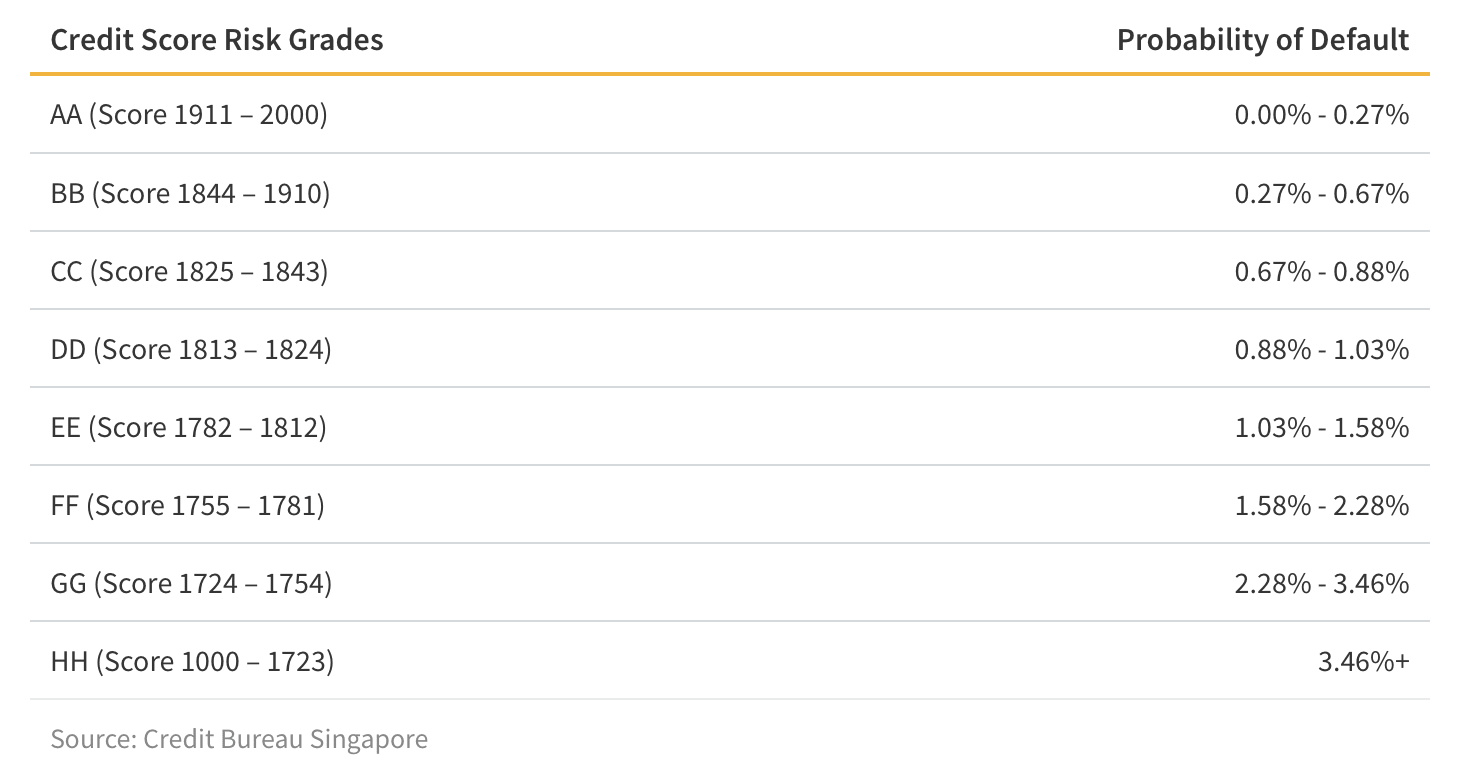

A credit score is a four digit number determined by your credit history that indicates to banks and lenders how reliable an individual is at repaying debt. Managed by the Credit Bureau of Singapore (CBS), this four-digit number ranges between 1,000 to 2,000 (AA rating of 2,000 being the best) and is an aggregation of your credit history across different banks and financial institutions.

Having a high credit score is essential to a stable financial life and achieving your long-term finance goals. Your credit score is an important factor considered by banks and financial institutions when you apply for credit cards and loans. You can leverage a high credit score to negotiate better interest rates on loans or apply for credit cards with better rewards, resulting in significant savings over time.

Whether you already have a decent score or you are rebuilding your credit, avoid these 5 common mistakes that can ruin your credit score.

1. Having Too many Credit Cards Or Loans At Once

Responsibly using a credit card or paying back a loan are easy ways to quickly build your credit. However, having too many open lines of credit is a red flag, indicating fiscal irresponsibility to financial institutions. As a rule, you should avoid having more than four or five credit cards and try to pay off outstanding debts before taking on more loans.

If you owe money to multiple financial institutions, you might want to consider applying for a debt consolidation plan (DCP). With a DCP, you can combine several outstanding debts into one loan that is easier to pay off.

Applying For Multiple Lines Of Credit In Succession

Another risky behaviour is applying for too many lines of credit at once. Every time you apply for a new credit card or loan, the lending institution involved will make an inquiry into your credit with the CBS. These inquiries are recorded and typically will be negatively reported in your credit history.

In fact, having too many over a short period of time indicates to lenders that you are looking to take on a lot of debt and will negatively impact your score. To play it safe, you should carefully consider your options before applying for a credit card or loan and be sure to close out existing lines of credit you aren’t using.

Your Debt-to-Income Ratio Is Too High

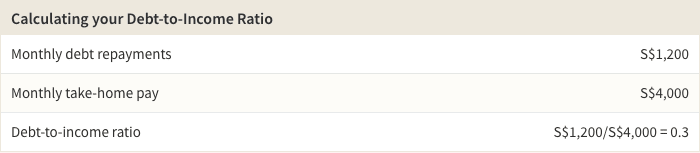

Keeping track of your Debt-to-Income ratio is a great way to set a budget and keep your credit healthy. To calculate this ratio, simply divide your monthly debt repayments by your monthly take-home pay. Naturally, the lower this number is, the better off you are. Here is an example of how to calculate your Debt-to-Income ratio.

A classic pitfall when trying to get out of debt is using an increase in income to take on more liabilities. For example, when someone in a significant amount of debt gets a promotion with a raise, they move into a nicer apartment or buy something expensive. To decrease your Debt-to-Income ratio, you should tackle existing debt as rapidly as possible and use increases in income to eliminate liabilities rather than add them on.

An institutionalised application of this ratio is the mortgage servicing ratio (MSR) used by lenders in Singapore to assess whether someone is qualified for a loan. MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying property loans, including the current loan being applied for. Before granting an applicant a loan, financial institutions must ensure a borrower’s MSR is less than 30%, using the following formula:

- (Monthly repayment instalments for all property loans / Gross monthly Income) x 100% ≤ 30%

In sum, keeping your Debt-to-Income ratio low will keep your credit score healthy and help you internalise good financial habits for achieving long-term goals like purchasing an HDB flat.

Paying Your Loans Late And Defaulting On Payments

This may seem like an obvious pitfall, but late payments and defaulting on payments have a very negative impact on your credit score. Young adults who are only starting to build their credit history often overlook a payment here and there. To avoid accidentally forgetting to pay a bill, you can set up autopay on your credit card or bank account to ensure you make payments on time.

Defaulting on a debt is the worst thing you can do for your credit score. While bad marks like late payments or too many lines of credit can be mitigated in less than 12 months, default records blemish your credit history for much longer. Default records with the status of “negotiated” or “full settlement” will be displayed for 3 years, while outstanding or “sold off” records can remain indefinitely.

Having No Credit

You might think that the best solution for avoiding a bad credit score is to simply never open a credit card or take out a loan. Unfortunately, this off-the-radar status means financial institutions have no indication of whether you are a reliable borrower. So, when you apply for a loan or credit card you will likely be denied.

Even worse, if you find yourself in need of a loan, you will have to rely on institutions with disadvantageous interest rates like licensed moneylenders. To responsibly start building your credit, you should consider applying for a credit card and earning cashback rewards or air miles while you develop your credit history.