How Can Parents Save in Face of Rising Education Costs in Singapore?

The rising cost of education is becoming increasingly problematic for families in Singapore that simply want their children to have the opportunity at a great education. In the last decade, the cost of education in Singapore has increased 21% faster than core inflation, which suggests that schooling is becoming more costly faster than other aspects of life in an already expensive place. In this article, we highlight some ways that parents can reduce the cost of their children’s education without cutting corners.

Plan Ahead for This Investment

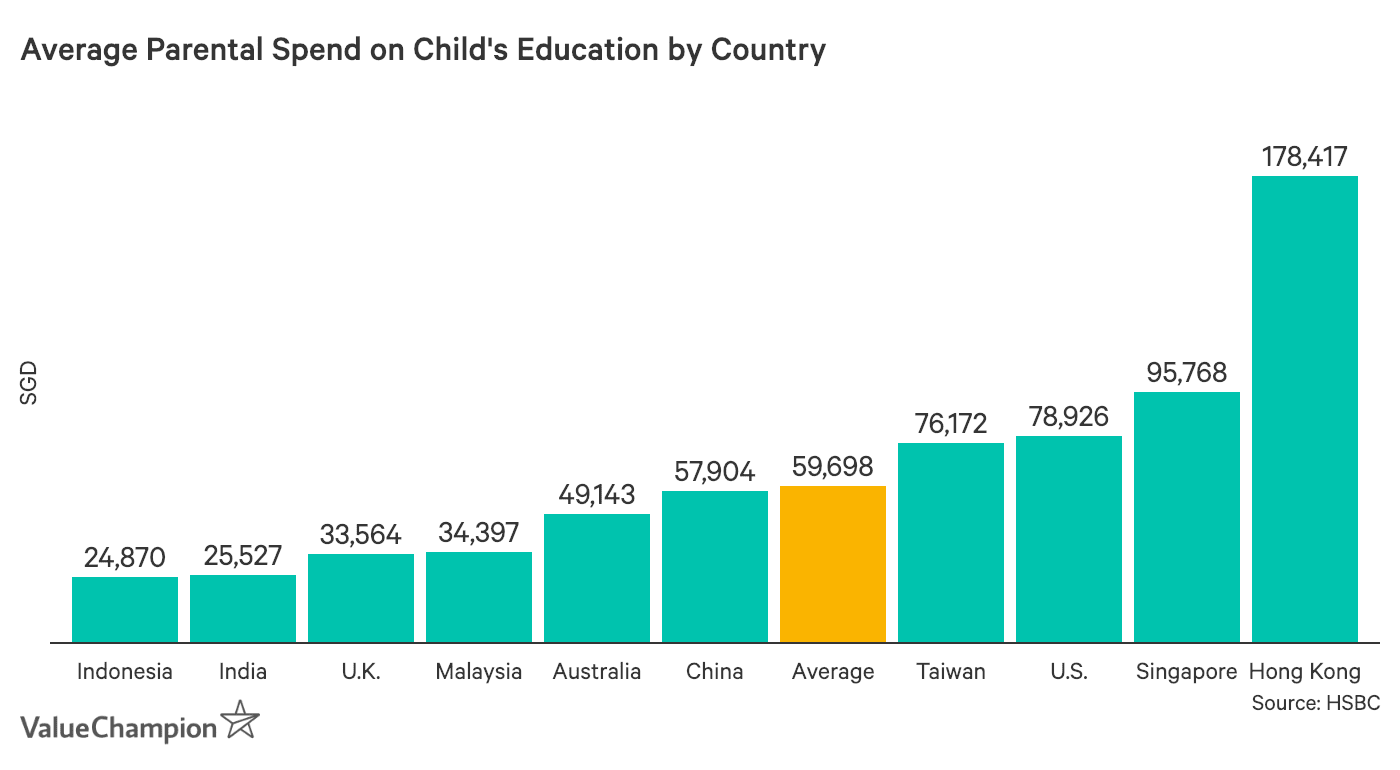

The sheer amount that it costs to educate a child from primary through university can be intimidating to parents. For example, HSBC’s Value of Education survey of parents and students found that Singaporean parents spend the second most of any country for their children’s educations at approximately S$95,768 per child over the course of their entire education. Furthermore, HSBC found that 47% of parents in Singapore wish they had started saving earlier for their child’s education and 42% wish they had saved more regularly. These factors indicate the importance of planning ahead for the sizable cost of your children’s educational needs.

What Should You Do to Make Paying For Your Child’s Education Easier?

Develop Savings and Investment Plans

Coming up with a strategy for saving for your child’s education is an important first step to making their schooling possible. First, you can research fees and tuition rates at various schools to come up with a ballpark estimate for your savings goal. Next, consider how much of your current budget can be dedicated to this cause. Then, you should consider automatically contributing that amount to a savings account, even if these contributions start out small. This will help you build the habit to save regularly and can help make you a more disciplined saver.

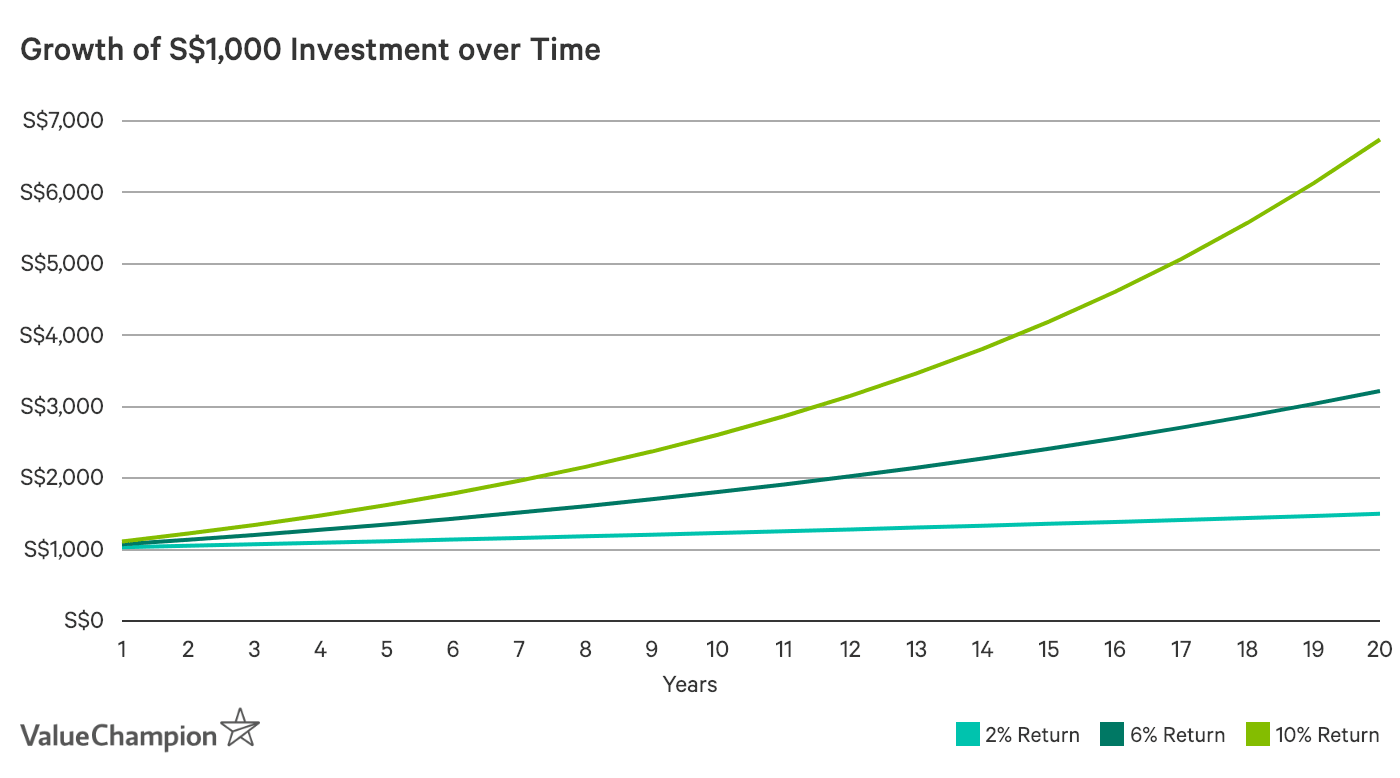

Savvy investors and those that have done the proper background reading and research should also consider investing in stocks, bonds and funds via an online brokerage. Depending on the amount of risk and research you are able to undertake, investing can help passively grow your savings over time. For example, an S$1,000 investment can more than double over 15 years given a 6% return rate as shown in the graph below.

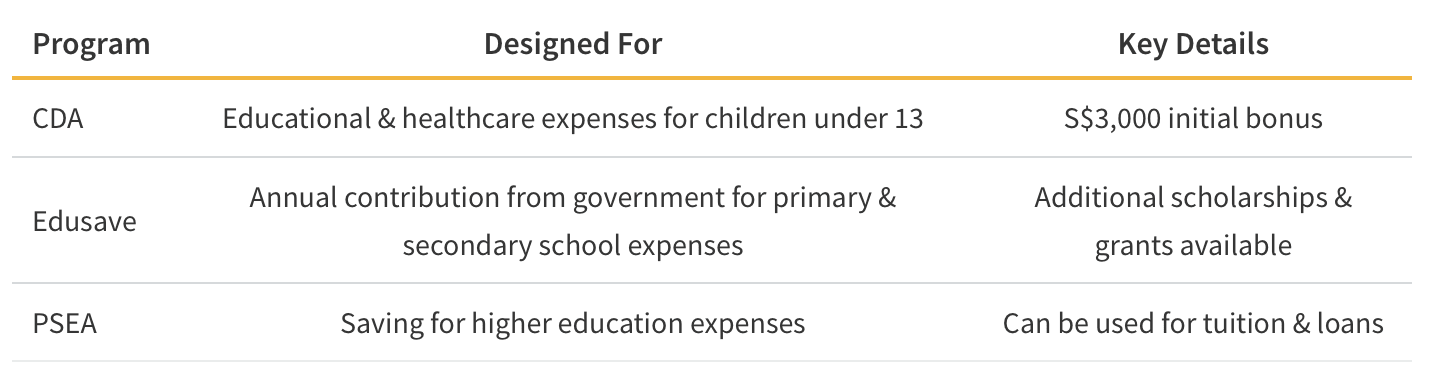

Take Advantage of Government Benefits

For those that have children or plan to have children, it is important to be aware of a few government benefits that can be used to save and pay for your child’s educational expenses. First of all, Child Development Accounts allow you to save money for educational and healthcare expenses for children at approved institutions. Not only is this a good way to to save for these expenses, the government will contribute S$3,000 to each child’s account when the child is born and will provide dollar-for-dollar matching whenever parents contribute to the CDA (up to S$3,000 for one child).

CDA accounts are also valuable for higher education cost as they can be rolled into a Post-Secondary Education Account (PSEA) when the child turns 13. PSEAs are a great way to save for your child’s college education. While they do not typically offer returns as high as the stock market (currently 2.5%), they typically offer higher interest rates than savings accounts making them a great way to save for higher education costs. For example, funds accumulated in a PSEA can be used at local universities and institutions approved by the government. It is important to also note that PSEA funds can be used for approved graduate programs and to pay for outstanding student loan balances.

Save Money on Tutoring by Using Online Learning Tools

Unfortunately for many parents, the cost of supplementary courses outside of school introduces a financial burden even before students attend university. Tuition centres and tutors often charge as much as S$60 to S$100 per hour, which can easily add up to thousands of dollars each year for each child. However, you may be able to save money by signing them up with an online tutor rather than sending them to a tuition center or hiring a private tutor. For example, Cudy provides a platform that connects students with tutors for a range of subject areas. These courses range in cost (typically S$20 - S$50 per lesson), but tend to be about 25% cheaper than those offered by in-person private tutors. Cudy even offers complimentary trial courses to give students the chance try its services for free. Not only that, by studying online you can reduce the amount of time your child would have to spend travelling to meet an in-person tutor.

If You Require Financing, Find the Best Education Loan

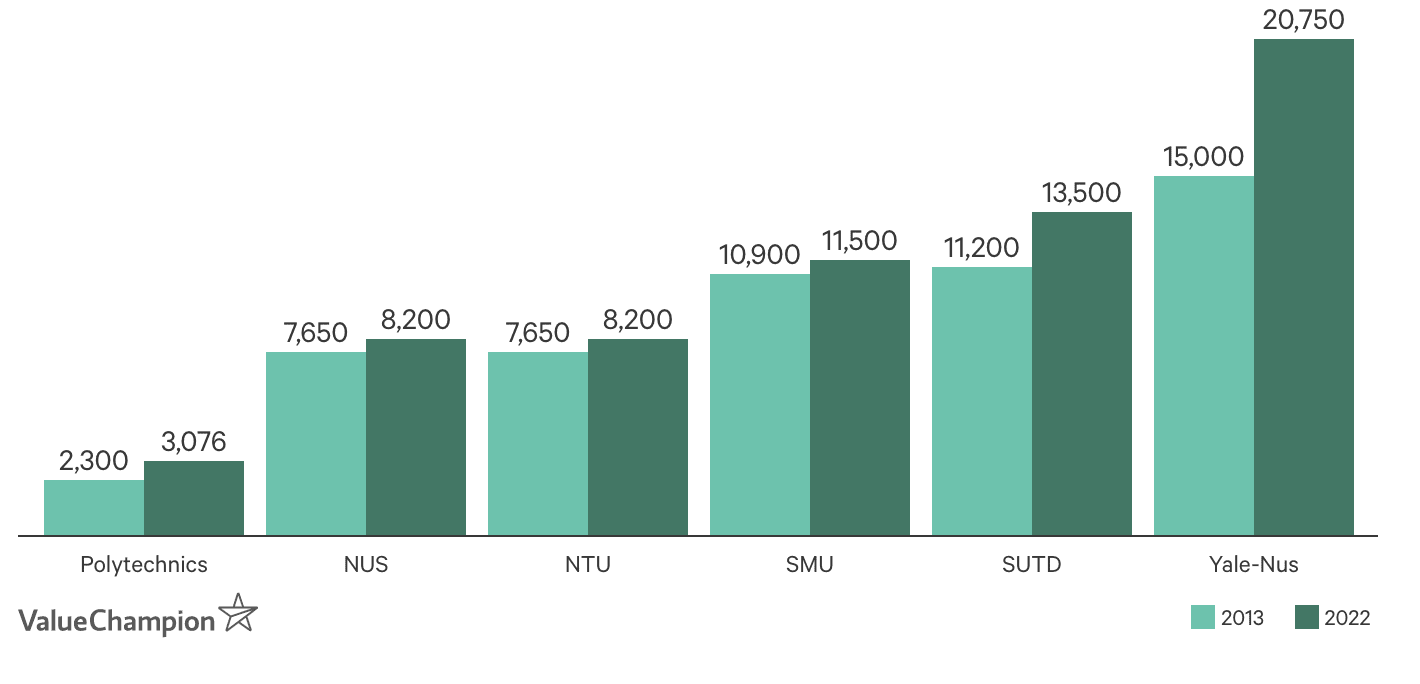

While the cost of education is rising in general, the cost of attending a university in Singapore has increased the most drastically. University fees have been on a steady incline since 2000, and although local universities momentarily froze their fees during the COVID-19 outbreak, the cost of a degree from these schools is still not cheap.

Additionally, you might also feel the brunt of the recent education inflation if your child is about to enter a Singaporean polytechnic or ITE, as fees for these institutions are set to increase again for the incoming batch in 2022.

Student loans are a possible way to make your child’s education more affordable, but not all student loans are created equally, so it is important to do some research in order to find the best fit for your financial circumstances.

First of all, it is important to compare rates and fees of student loans in order to understand their total cost of borrowing. With that said, it is crucial to make sure that you are able to make the monthly repayments required for the loan you choose. If you or your child will not be able to make large monthly payments, there are graduated payment structures that allows you to pay less or even nothing, while your child is still studying. The downside to these loans is that they tend to cost more over the tenure of the loan as they charge higher interest rates once your child graduates.

It’s also important to consider that different student loans cater to different types of education: the option that is the most well-suited to full-time polytechnic students might not be the same as the one that’s the best for part-time university students. And if your student is considering attending an international university, there are loans that cater specifically to funding overseas education. Hence, it is crucial to do your research by comparing the different education loans available and choosing the one that best suits your child’s educational needs.

Conclusion

Despite the high cost of schooling in Singapore, there are still multiple ways to ensure that your child gets the education that they deserve. By planning ahead, adopting methods to save cost, or even getting a student loan to aid in paying for polytechnic or tertiary education, students can enroll in their dream course without worry.