Financial Protection Against COVID-19: 5 Things to Know About Your Insurance Coverage

As Singapore continues to increase safety measures to protect the public against the ongoing threat of COVID-19 by encouraging staying at home and closing non-essential businesses, many individuals are left wondering about their financial and personal security. Since COVID-19 symptoms range from mild to severe enough to induce ICU hospitalisation, the financial ramifications of getting sick can be significant. Furthermore, with non-essential business shut down, people who are newly out of work now have to figure out how to pay their bills. Because of these drastic lifestyle changes, we have seen insurance companies respond by adapting their policies and increasing coverage. Whether you are looking for new coverage, need help paying for your current plans or are concerned about your current coverage, we explain the major changes to your insurance policies.

Integrated Shield Plans Provide Full COVID-19 Coverage

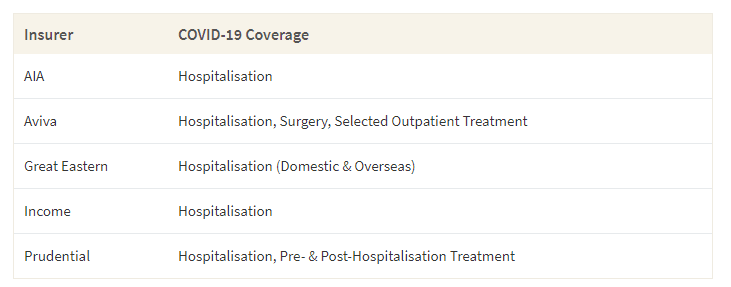

The most comforting news is that your Integrated Shield Plan will cover COVID-19 hospitalisations. The extent of the coverage depends on the insurer, but it typically ranges from hospitalisation to outpatient treatment. Some insurers, like Great Eastern, will also cover you if you are getting treated for COVID-19 outside of Singapore. While IPs provide full coverage for your hospital bills, you should note that you will still be responsible for paying the copay and deductible. You should also stick to the hospital ward you are insured for to avoid paying higher out-of-pocket costs.

Insurers and their Integrated Shield Plan Coverage for COVID-19

However, you don't have to go out and buy an Integrated Shield Plan—and it may be more prudent not to if you can't afford the premiums. Instead, you should note that the Singapore government will pay for medical bills for COVID-19 related inpatient treatment at public hospitals. The exception will be for outpatient treatment at GP clinics, polyclinics and private hospitals.

Coverage Isn't Limited to Health Insurance Plans

If you have a life insurance, personal accident or critical illness plan, your coverage will be extended to cover COVID-19 claims. Life insurance policies will cover death and terminal illness claims related to COVID-19. Personal accident plans will also cover COVID-19, but you should be aware that you may need an infectious disease add-on. Since COVID-19 isn't a critical illness, your critical illness plan won't cover COVID-19 directly. However, critical illness plans may cover complications due to COVID-19, like end stage lung disease.

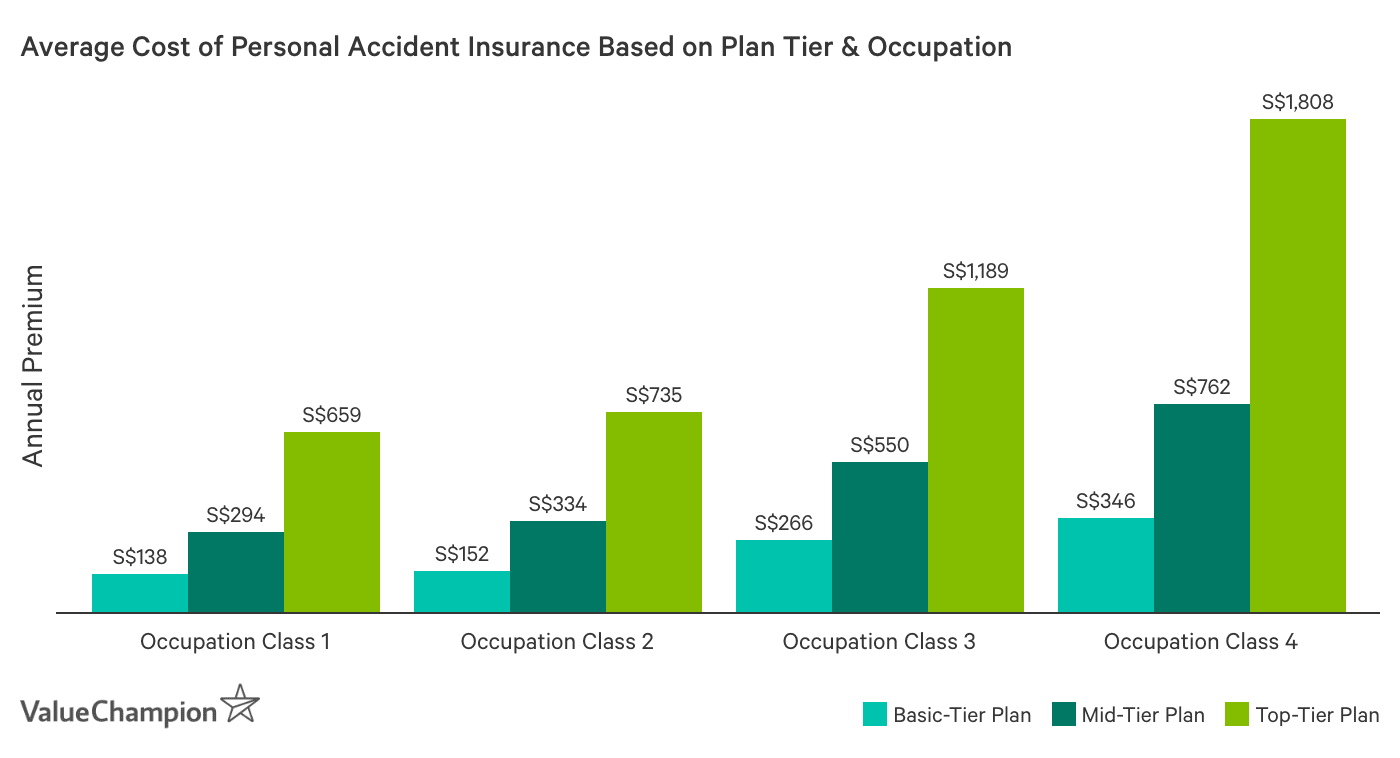

If you don't have any additional insurance policies but want additional coverage against COVID-19, you can consider a personal accident plan. These plans are not as comprehensive as IPs and they don't require long-term financial commitment like life insurance policies. Instead, they provide coverage for infectious diseases and accidents and can be good if you want supplemental coverage during this time. Benefits included in these plans include medical expense coverage, daily hospital cash income and a death benefit if you contract COVID-19.

However, you should be aware of a couple of caveats surrounding COVID-19 coverage for personal accident plans. First, you should pay attention to any waiting periods. If you contract COVID-19 before the waiting period ends, you won't be covered. Second, you will only be covered if you contracted the disease in Singapore. This is because travel is currently advised against and insurers won't cover claims made by individuals who knowingly increase their risk by travelling. Nonetheless, a personal accident plan could be an affordable short-term option as some plans cost less than S$20 per month.

Domestic Worker Insurance May Cover COVID-19 Claims

Those worried about the health of their foreign domestic worker (FDW) can check with their insurer to see if COVID-19 is a covered condition. As of now, only Income advertises COVID-19 coverage for their domestic helper plan. FDW Employers should reach out to their insurers to see if hospitalisation and medical claims due to COVID-19 will be covered. Since there currently isn't clear information regarding coverage, you should make sure your domestic worker has a strong understanding of social distancing and adjusts her work schedule accordingly.

Travel Claims Related to COVID-19 Remain Strict

You may be able to claim for trip cancellation, delay or curtailment due to COVID-19. However, this is wholly dependent on your insurer, the day you bought the policy, and your trip dates. For instance, AIA customers who bought a travel insurance policy between March 3rd and March 12th can file COVID-19 cancellation or curtailment claims for trips to France, Spain and Germany, but can't file those claims if their destinations were Japan or South Korea. Other insurers, like Aviva, won't cover any COVID-19 related claims if customers purchased their policies as early as January 20th 2020.

If you want to cancel your travel plans, you may also get refunded for your travel insurance premium, but once again this is dependent on when you purchased the policy and when your trip dates. You should note that it is standard industry practice to not cover claims that arise from "known events", which is why you won't be covered for COVID-19 related claims if you bought the policy after travel advisories were administered and the pandemic was declared.

If You're Unable to Pay Premiums

If you were financially impacted by COVID-19 and you are unable to pay your current premiums, you can check to see if your insurer is allowing payment deferrals. The eligibility for premium deferral differs from insurer to insurer, but in most cases if you'll be allowed to defer payments if you lost your job, were put on a no-pay leave or sustained a drop in income due to COVID-19 regulations. For instance, some insurers are allowing for a 6-month payment deferral for their health and life insurance policyholders, while others are also including a flexible installment payment plans for HDB fire and motor insurance plans.

One thing you should note is that you may have to pay a lump sum of all the premium payments you missed when your deferment ends. So for instance, if your monthly premium is S$200 and you defer your payment for 6 months, you will owe S$1,200 at the end of the period. Thus, while this can be a good solution for the present, you still have to make sure you save enough money to pay back the full amount when your deferment ends. Otherwise, your policy may terminate. While it may be tempting to buy a policy to make sure you are well-protected from large hospital bills, you should always keep in mind your ability to pay for the plans. You should shop around and carefully compare premiums to make sure you get a plan that provides coverage for your concerns but won't create any unnecessary financial burdens.