Renewing Your Mortgage Loan: Why, When and How You Should Do It

A mortgage loan is likely the biggest financial instrument an average person has to deal with in her entire life. Although it has a humongous impact on a person life, it also is one of the most foreign subjects for many, since they only have to deal with it once or twice in their lives. However, it's actually one area of personal finance that should be highlight optimised. Here, we discuss one of the best ways to actively manage one's home loan, i.e. refinancing, to help people make fewer mistakes and save a significant amount of money over the long run.

Why Should You Refinance Your Mortgage Loan?

The biggest reason for refinancing your home mortgage loan would be because the market rates have been, and will continue increasing. The US Federal Reserve is set to continue hiking its rates for the foreseeable future, and the Singapore Interbank Offered Rate (SIBOR), which most home loan rates are based on, has generally correlated with the US rates throughout its history. As a case in point, 3-Month SIBOR has already increased by 17% since beginning of 2017, and several banks in Singapore have been announcing their home loan rate hikes one after another.

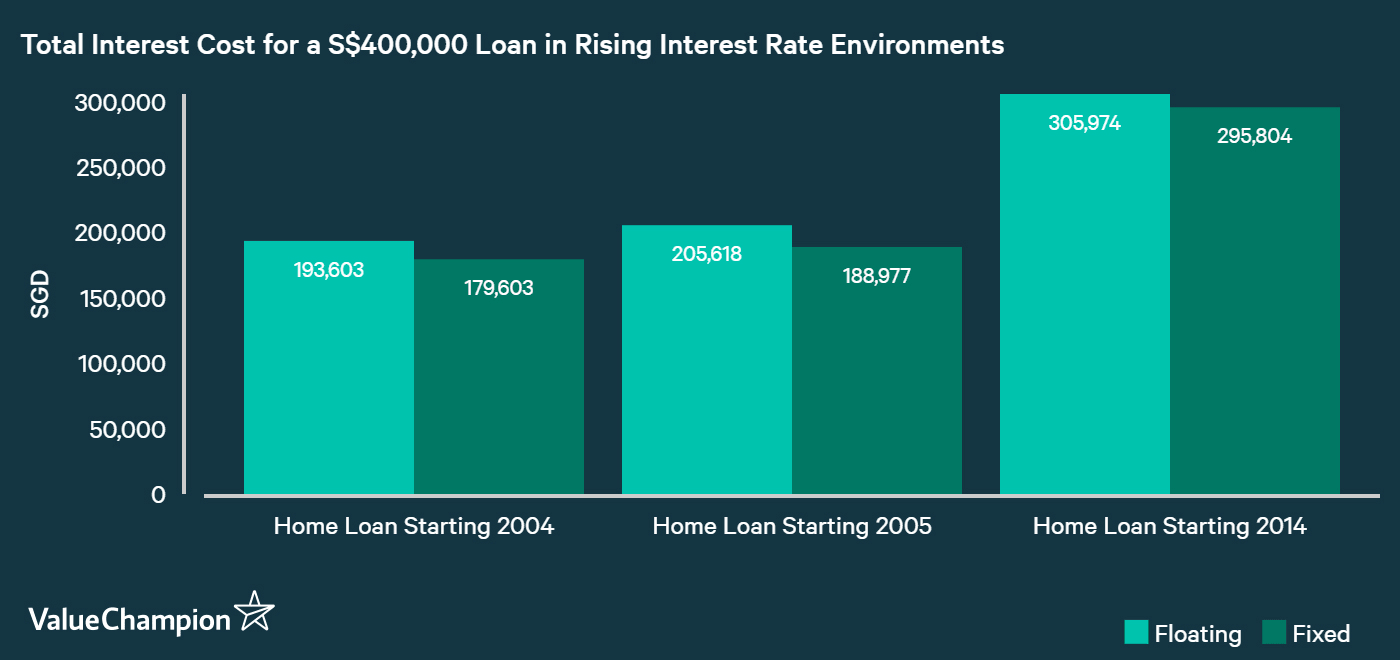

In Singapore, most home loans are structured as either a floating rate loan or a fixed rate loan. Floating rate refers to an arrangement where the loan's interest rate reflects the market interest rate fluctuations; if market rates increase, then the loan's rate also increases. On the other hand, fixed rate loans charge a predetermined interest rate for a few years, after which it also transitions into a floating rate loan. In today's rising rate environment, it's generally advisable to get a fixed rate loan instead of a floating rate loan to offset the impact of rising rates. In the past few economic cycles with a similar rate environment, fixed rate loans were known to save at least S$10,000 in interest for a loan of S$400,000. By taking this further, one could save even more by continuing to refinance his home loan into a fixed fixed rate loan in order to lock in a specific rate until rates start to stabilize or fall.

When Should You Refinance Your Housing Loan?

In general, it's wise to refinance your loan as frequently as possible in a rising rate environment. In today's market, this means that you should look to refinance your loan every 2-3 years when your loan's lock up period expires. Avoiding lock up periods is especially important because refinancing before it expires will result in a penalty fee of 1.5% of your loan, which can easily be thousands of dollars when it comes to home loans. You should also be wary of refinancing before rate "reset" or "review" dates that generally occurs every 1 to 3 months; violating this rule can result in a 0.5% penalty fee even after the lock up period has expired.

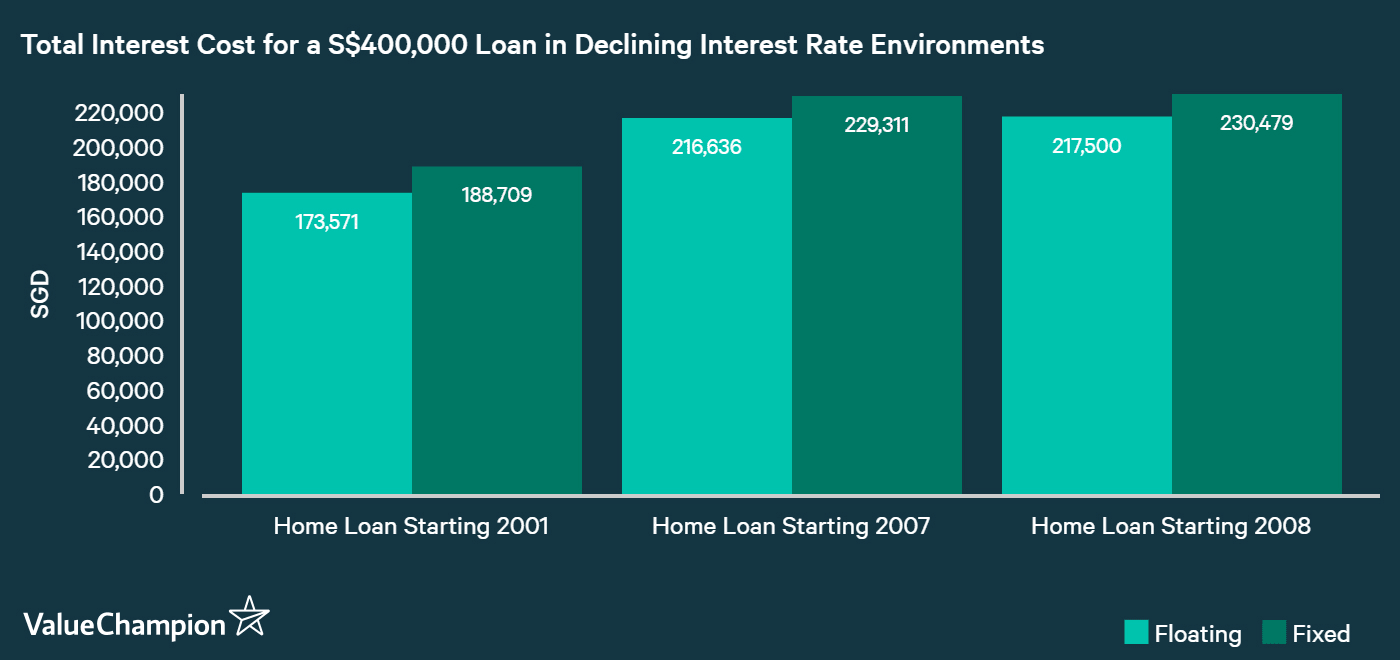

Finally, it's not advisable to refinance your home loan in a stable to falling rate environment. Banks typically charge a higher interest on fixed-rate loans in order to reflect the premium you are getting from knowing exactly how much to pay each month. Therefore, floating rates tend to be the better bargain that allows you to benefit from falling rates over time. This very well could be the case in a few years when the rates are done increasing.

How Should You Refinance Your Home Loan?

To refinance your housing loan, the first thing to do is to check whether your loan is eligible, i.e. its lock-in period has expired and that it is cleared for its rate renewal date. Then, you should compare the best rates on a tool like ours in the link to see what is available in the market. This tool also allows you to easily apply for a loan online, so that you can consult a home loan expert who has a ton of experience dealing with refinancing for dozens of clients. They could help you assess whether you should refinance, when and which options are the most ideal for your circumstances. While it may sound easier to just return to your current bank who may make a renewal offer to retain your business, but it is always a good idea to start a competitive process involving a mortgage broker and other banks to ensure that you get the best option possible.