How Does Car Age Affect Car Insurance Premiums?

Get the Best Car Insurance in Singapore

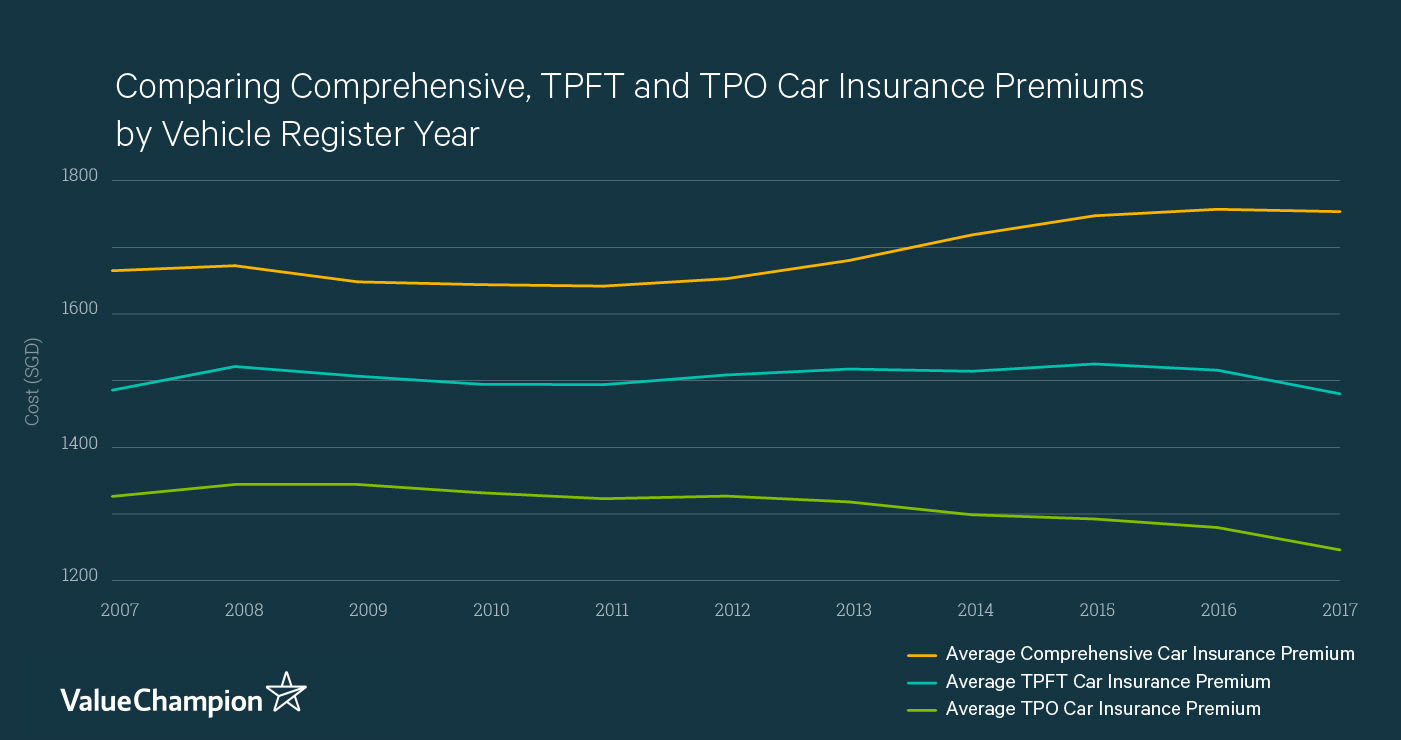

We've all heard that car insurance premiums tend to rise as cars get older. But is it a universal fact? If you own an older vehicle, are you better served in the long run by one insurer over another? And does it matter which kind of policy you buy? Our team at ValueChampion compared the cost of premiums for comprehensive, third party, fire and theft and third party only car insurance plans among a variety of Singapore's major insurers to find out.

Comprehensive Plans

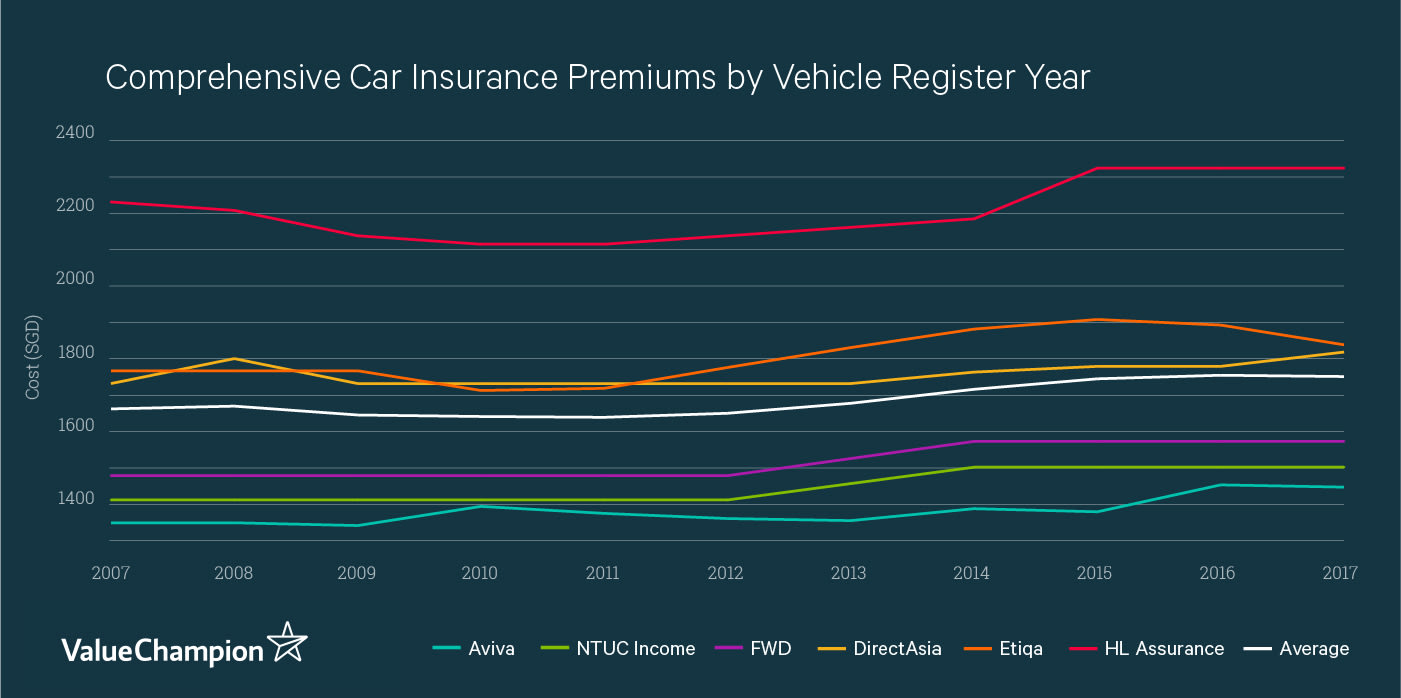

Our study of 6 major insurers' comprehensive plans for the Toyota Corolla Altis 1.6 showed that car insurance comprehensive policies actually tend to be the most expensive for new cars. Prices tend to decline until cars hit about 8 years of age, after which point they begin to rise again slightly. The average premium for a comprehensive plan fares at about $860 for cars registered from 2015 to 2017. For vehicles over the age of 7, the average insurer will tend to charge a little more for each additional year of age.

A closer look at the data shows that among the insurers we surveyed, some stick out in particular. Singlife with Aviva charges the lowest premiums for each vehicle registration year for the Toyota Corolla Altis 1.6. NTUC Income and FWD are outliers in that they do not raise premiums at all for aged cars, instead offering their cheapest rates for cars registered before 2013.

Third Party, Fire and Theft Plans & Third Party Only Plans

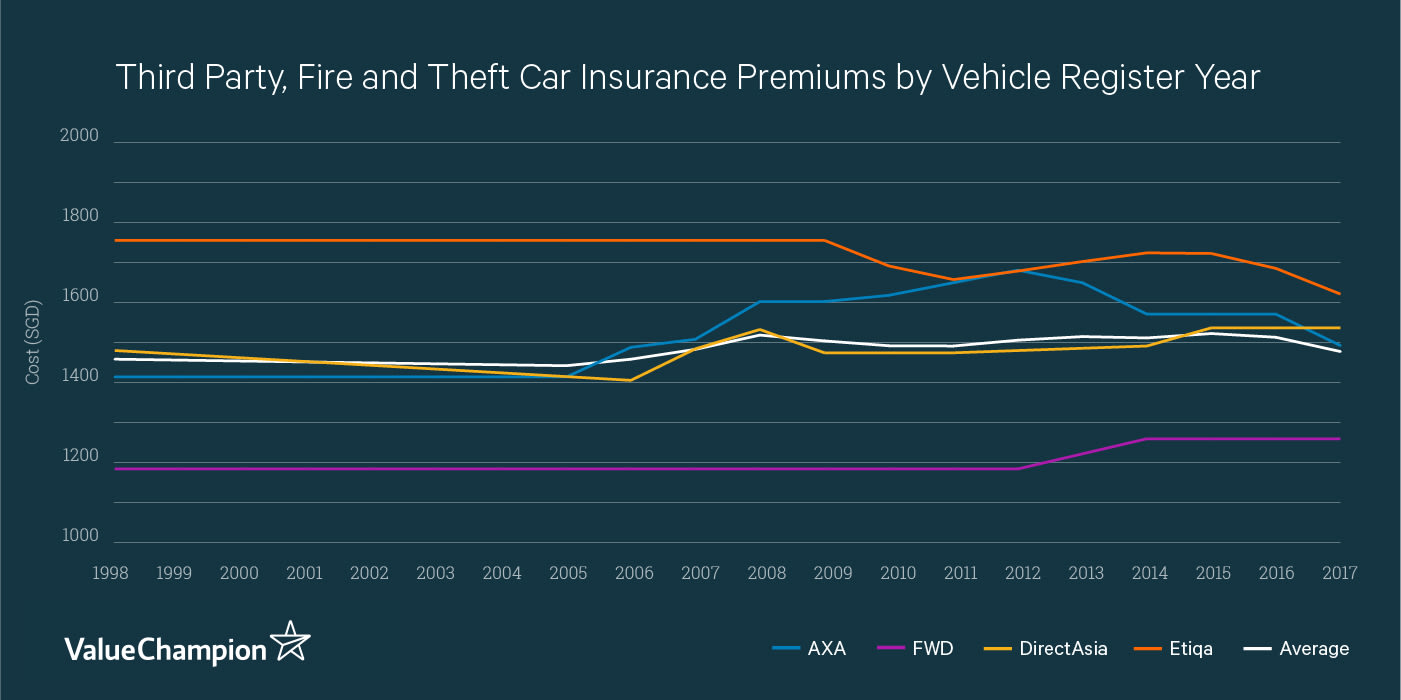

For third party, fire and theft plans, we found that insurers tend to charge the highest premiums for cars under the age of 10; premiums fall once cars hit 10 years of age, and then begin to slowly increase again as the car ages. Of note, FWD stuck out as offering noticeably lower premiums than its competition for TPFT plans and for not increasing premium prices on aging cars. We also found that the age of the vehicle had the least impact on FWD premiums.

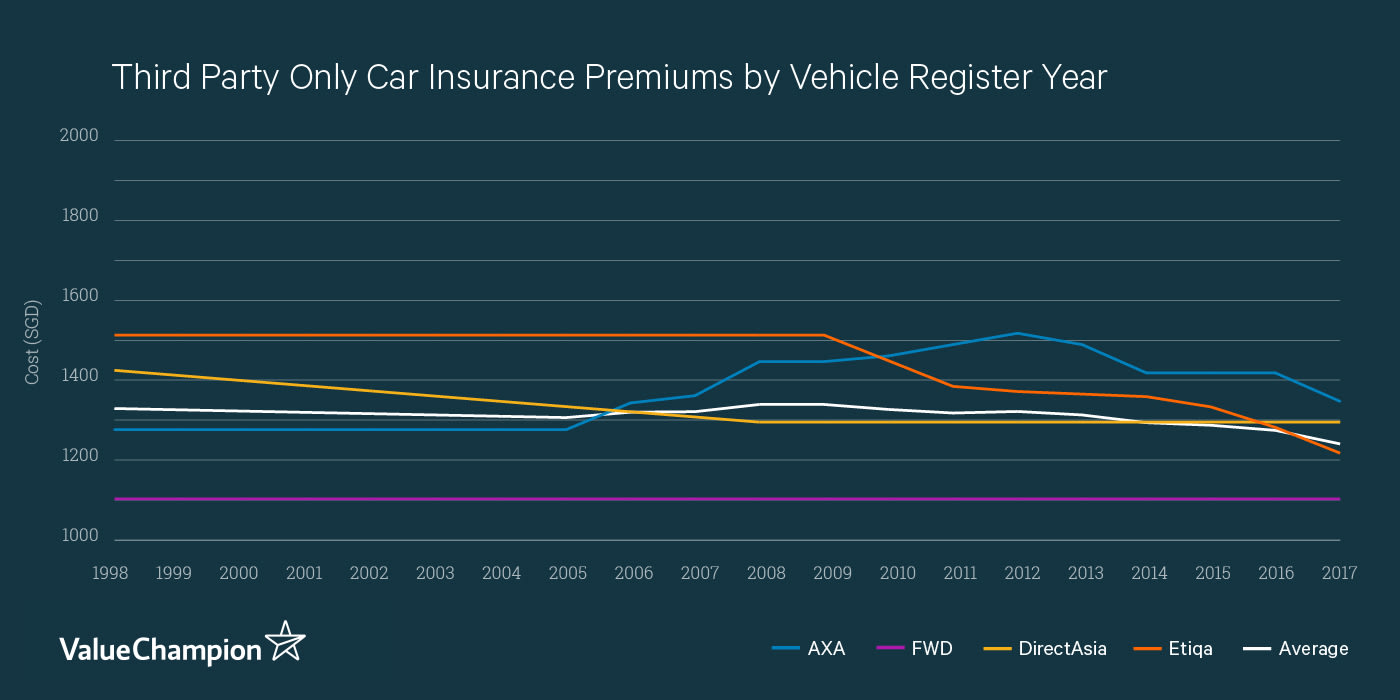

In contrast to comprehensive and TPFT plans, premiums for third party only plans tend to be cheapest for new cars and gently increase as cars age. However, we found that this general trend of gradually rising premiums may mask the fact that there is actually a great deal of variation in how different insurers adjust their prices depending on the car's age. In fact, some insurers may actually decrease their premiums rather significantly or not change them at all for cars aging into their teens.

Conclusion

While conventional wisdom might lead us to believe that paying higher premiums for your car insurance as your car ages is an inevitability, our study showed that this is not always the case. Certain insurers may offer their lowest premiums for the newest cars and others may actually offer their lowest premiums to cars entering their teens. This means that you should make sure to have an idea of how your premiums are likely to increase or decrease with your current insurer as your car gets older.

This is especially important to keep an eye on because as your car approaches (or even passes) 10 years of age, you may consider switching to some form of third party car insurance plan with the goal of saving money. We found that switching to a third party insurance plan such as a TPFT policy may not save you as much money as you might think as your car approaches that 10-year mark. For instance, our study of Toyota Corolla Altis 1.6 premiums showed that for cars at least two years old, Singlife with Aviva's comprehensive insurance policy is consistently cheaper than all but one TPFT policy offered by other insurers and several insurers' TPO policies.

On the other hand, some insurers that charged relatively high premiums for comprehensive plans and/or newer vehicles may actually begin to offer quite competitive rates for third party plans and/or older vehicles. One example of this is AXA, which offers among the most competitive premiums for TPO plans for cars already over the age of 10. FWD could also be a good option for individuals hoping to maximise savings on their car insurance, as their TPFT and TPO policies cost hundreds of dollars less than the competition.

Methodology

We used the driver profile of a 30 year old single male with 2 years' driving experience and a 0% NCD who drives a Toyota Corolla Altis 1.6 to collect quotes. To ensure a fair comparison, we held all variables constant except for Vehicle Registration Year.

Our research and average costs reflect quotes collected from Singlife with Aviva, NTUC Income, AXA, FWD, DirectAsia, Etiqa and HL Assurance. These insurers were chosen for their prominence in the Singapore car insurance market and the ability to collect online quotes through their websites.

For TPO and TPFT plans, NTUC Income, Singlife with Aviva and HL Assurance are not represented because their online quote-finding tools do not allow the selection of TPO or TPFT plans. For Comprehensive plans, we chose not to include AXA as its insurance premiums skewed much higher on average than premiums from other insurers surveyed, which we decided would disproportionately distort the industry average. For example, its online quote tool returned a premium of S$3,562 for a Toyota Corolla Altis 1.6 registered in 2013, which more than doubled the average of the other 6 insurers for that vehicle age (S$1,650).