How Rich Do You Have to Be to Own Landed Property in Singapore?

One of the most coveted types of real estate property in Singapore is the landed property. Peppered throughout Singapore among the towering HDB's and Condos, landed properties can both inspire and act as a stark reminder of Singapore's wealth gap. So how much do you actually have to earn to be able to afford a landed property? Below, we take a look at the costs are associated with owning a landed property and how much you need to earn to afford one.

How Much Do Landed Properties Cost?

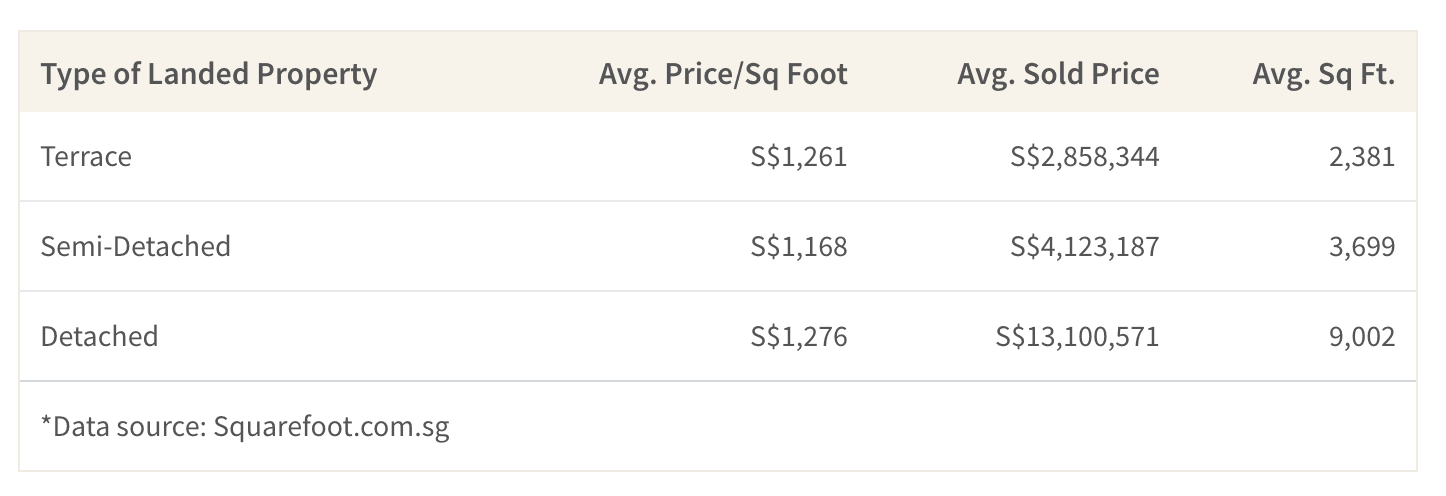

Depending on the type of landed property you want to get, you can expect to pay between a few hundred thousand dollars up to S$100 million. When breaking down the landed properties into their categories, we found that a fully detached bungalow sold for an average of S$13,100,000, semi-detached properties sold for an average of S$4,123,200 and terrace houses sold for an average of S$2,858,000 in the first 6 months of 2018. The most expensive properties are Good Class Bungalows (GCBs) which typically cover over 1,400 square metres and are quite rare, with only around 2,700 of them built. These are located mainly in District 10 and 11 and cost more than S$1,600 per square foot.

Furthermore, landed properties come with different types of leaseholds which can also change how much a home costs. Freehold properties are the most expensive, followed by 999-year leaseholds and 99-year leaseholds. Intuitively, the less years left on a leasehold, the cheaper it is. Thus, while you may not be able to afford a GCB, you may be able to afford a smaller 99-year lease semi-detached home with around 10-30 years left. In fact, there are a couple on the market that cost between S$300,000 and S$400,000—less than the average price of a 4-room HDB resale flat.

Only the Top 5% of Earners Can Afford a Landed Property

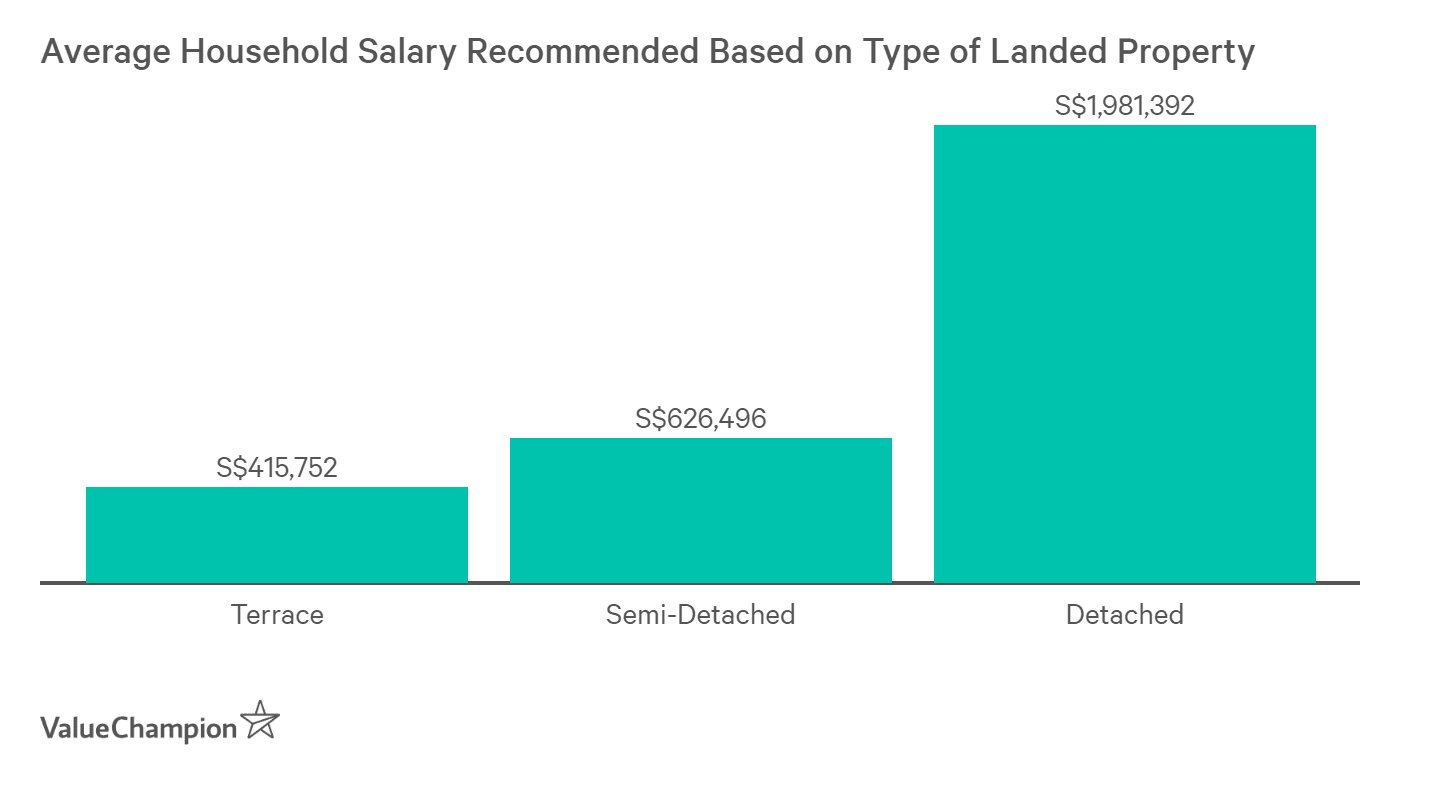

On average, you would need to have a monthly income of around S$34,646 per household to afford the average terrace house sold in the first half of 2018—putting you in the top 5% of earners in Singapore. These 6-figure-per-month earners include specialist medical practitioners, CFOs, financial directors and lawyers. Nonetheless, financing a terrace home is still be a costly endeavour. If we assume that you are making a downpayment of 25%, you will need S$714,590 for the downpayment and will pay about S$9,086 for your monthly mortgage payment given an interest rate of approximately 2%.

On the other end of the spectrum, to afford a relatively less expensive detached bungalow, you'd need an average monthly household salary of S$165,116 to be able to afford monthly mortgage payments. Not only that, but you would also need around S$3,275,143 of spare cash just for the 25% down payment. This down payment alone is already 30 times greater than the median Singaporean household salary. Furthermore, not only will your monthly mortgage be around S$41,279, but you will also end up paying S$2.7 million and S$4.2 million dollars in total interest (that is, if you're not buying the property in cash). Thus, the majority of the people who can afford bungalows,especially GCBs, are very high income individuals.

Expected Costs of Maintaining a Landed House

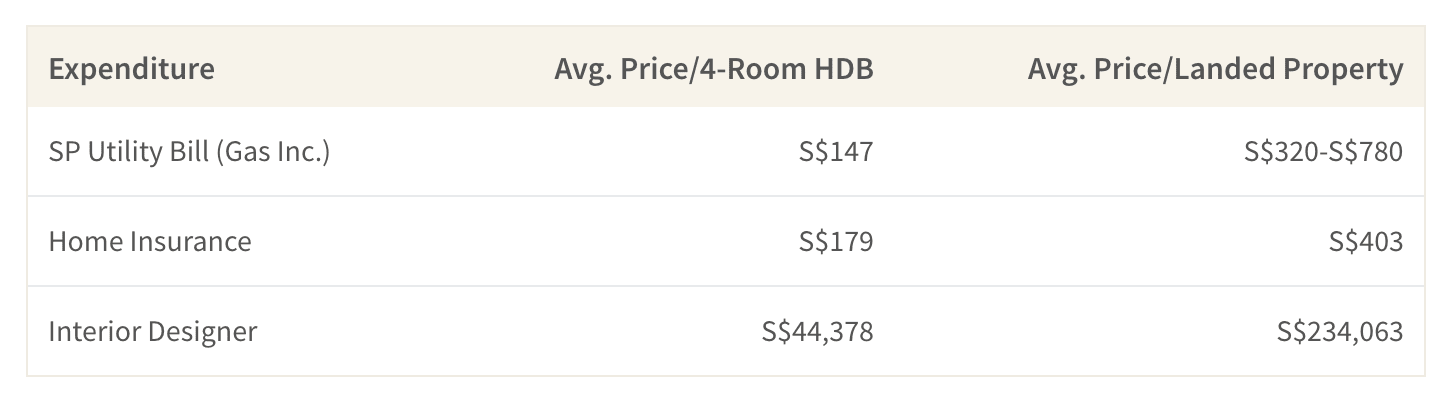

In addition to the upfront costs of purchasing a landed property being higher, you should expect to pay more for everything from home insurance to energy bills. For instance, landed property owners on average spend 110% more on home insurance than HDB and Condo owners. Furthermore, you should also expect to spend a lot more on furnishings and renovations due to the sheer increase in size compared to the typical HDB and Condo.

Landed Properties Are Expensive But Not All Are Unattainable

For most Singaporeans, buying a landed property seems like a pipe dream. However, the affordability of any residential property depends on everything from luck to careful and long-term planning. For instance, while some people may have received a large inheritance or received the property as a gift, others may have planned and saved for a long time and got into the market at the right time. Thus, the amount you may need may be different than the numbers discussed here depending on the amount of your CPF savings, mortgage interest rates and the state of the property market. We'd love to know, what kind of property would you ideally want to own? And if you live in a landed property, do you think it's worth the extra cost?