How Much Risk Do Homes in Singapore Actually Face?

When you last moved into a new place, you probably remember either purchasing or hearing about purchasing an insurance policy for your home. But how much risk does your home actually face and are these policies worth your money? Here, we delve into a few main factors that could potentially put your home or your home contents at risks: namely fire and theft.

Probability of Residences Experiencing Theft, Fire or Break-In

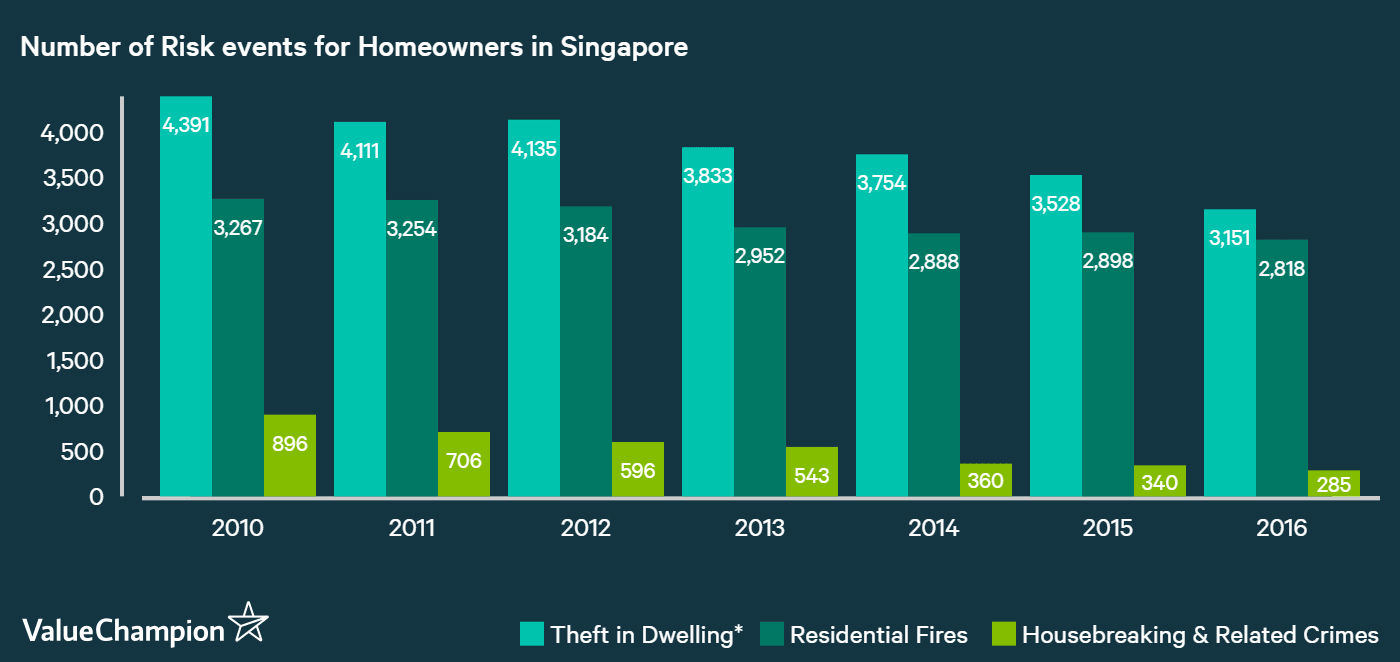

According to ValueChampion's assessment of the Singapore Police Force and Singapore Civil Defense Force's data, a resident household in Singapore has approximately 0.58% probability of experiencing either a theft, housebreaking or fire in their residence in any given year. This is based on 1,010 residential fires, 160 housebreakings and 6,843 thefts in dwelling that occurred in 2021 compared to 1.39 million resident households in the country. Luckily, these incidents have been declining in their frequency quite dramatically over the last few years. For instance, the number of residential fires have declined by over -14%, housebreaking by -68% and theft in dwelling by -28% since 2010.

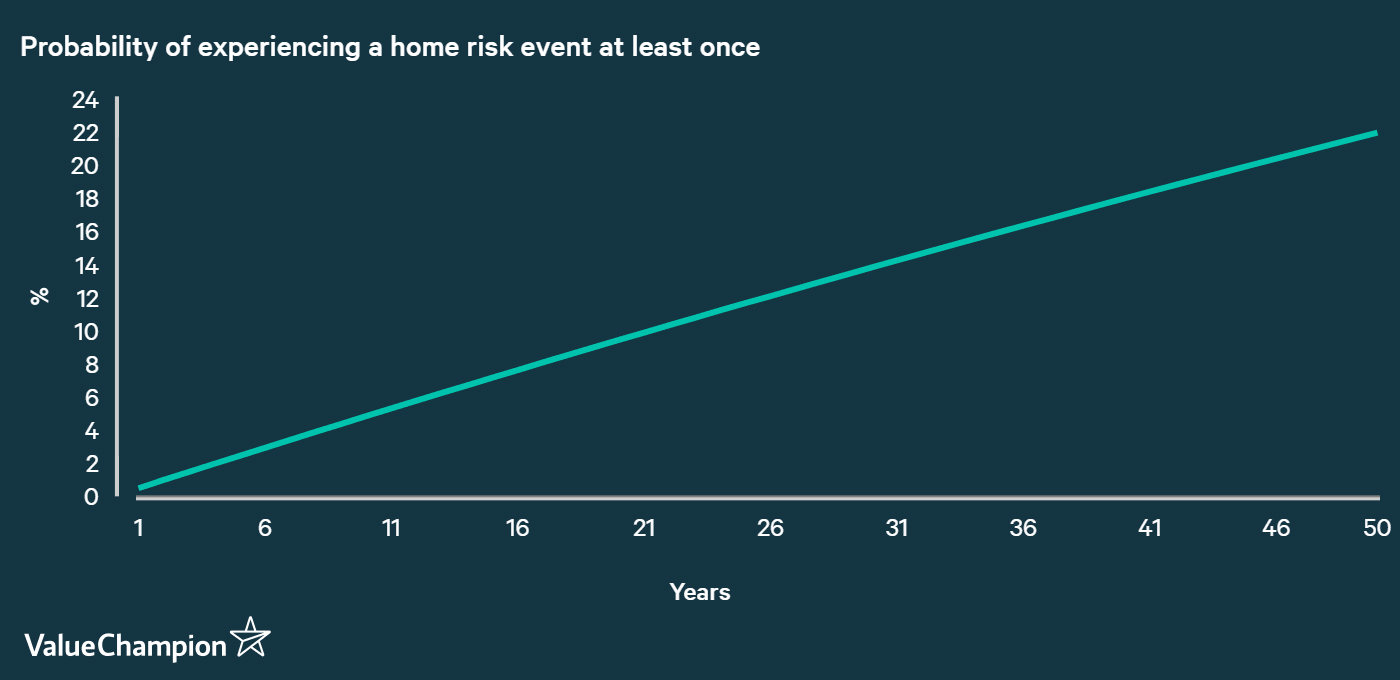

While 0.58% may not sound like a very high number, it can increase dramatically to more than 20% if you consider the probability of experiencing any of these events at least once over the course of 50 years. Given just how invaluable your home, furnitures and belongings can be, the fact that there's a 20% chance of your house either being robbed or seriously damaged over the course of your lifetime is not exactly reassuring.

Home Insurance's Value

As far as homes are concerned, most homeowners in Singapore already have what is called a "fire insurance." This mandatory policy basically protects the "structure" of your flat or home in case of natural disasters like fire. However, you may be surprised to hear that these policies won't compensate you for any furniture, personal belongings (i.e. jewelries or electronics) or renovation work inside of the house that are stolen or destroyed.

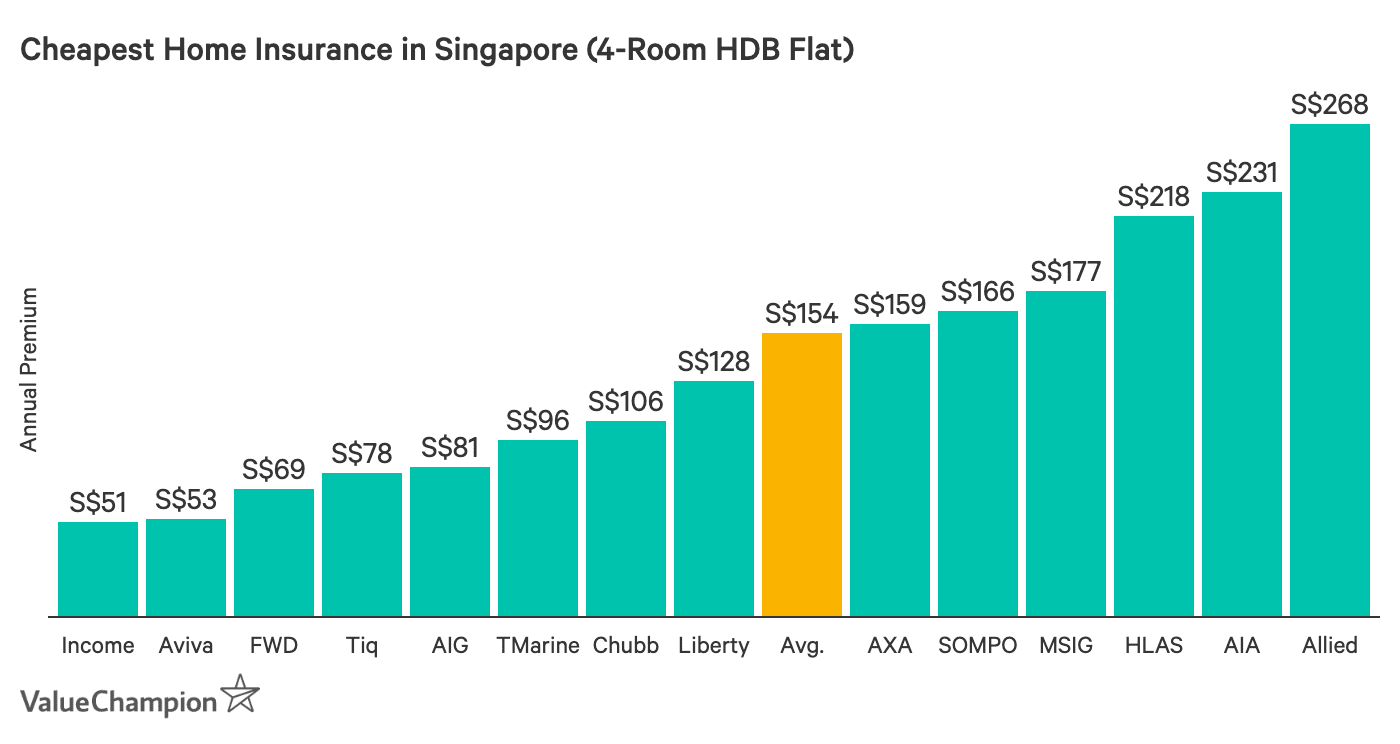

Instead, to protect these home contents and renovation works, you have to purchase a separate policy frequently called "home contents insurance" or "home insurance." Because they cost as little as S$30 to S$50 per year, home insurance policies can be an effective way of protecting tens of thousands of dollars of investments you've made on your new fixtures, furniture and other things in your house.

We can actually compare the total cost of paying for a home insurance against the potential loss you face if you don't have protection. For instance, A 20% chance of losing S$50,000 in the next 50 years represents "expected loss" of S$10,000. This about 4x higher than the S$2,500 you would've paid for a policy that costs S$50 per year for the same length of time. Sure, one may think that the probability of a theft or fire happening at your home may seem low in a given year. But, not only is the probability not that low over the course of a lifetime, but it can also be a financial disaster that can easily cost you S$30,000 or more if and when it does happen. Why take that risk to save a few bucks?

Importance of Protection

There are a few things in life that are highly unlikely to occur but are terribly damaging when they do. This is where insurance comes into play. By purchasing protection against certain low-risk high-loss events, we are able to ensure that we are able to receive recompense and recuperate from our loss if we get into a car accident, need major medical expenditure, or lose something very valuable. This rings true even more if you consider that some of these "life changing" catastrophes could be black swan events that tend to happen more often than typical statistics would lead us to believe. While the most important protection we buy tend to be related to our life and health, our homes and home contents are also major financial assets that are difficult to replace once they are damaged or lost.