4 Ways to Be a Smarter Holiday Shopper This Year

The holidays are a wonderful time of year to spend time with family and friends. Many of us would like to shower these loved ones in gifts. However, navigating the budgeting and shopping processes can be tricky for all of us. To help, we've outlined a number of ways to make your holiday shopping as financially responsible as possible.

Set a Limit for Your Holiday Spending Budget

If you are truly serious about monitoring your finances during the holiday season, it is crucial to set a budget for the gifts that you plan to buy. To start, make a list of all the people you want to give gifts. Next, list or estimate the price of the gifts that you plan to give to each individual and sum the total. If this amount is more than you have saved or will be able to spend based on your monthly income, you may need to reduce the number of individuals on your list or the value of some of the gifts you plan to give. This can be one of the most frustrating parts of planning your holiday shopping, but is also one of the most necessary in terms of ensuring that you don't overspend this year.

Look Out for Price Matching Deals

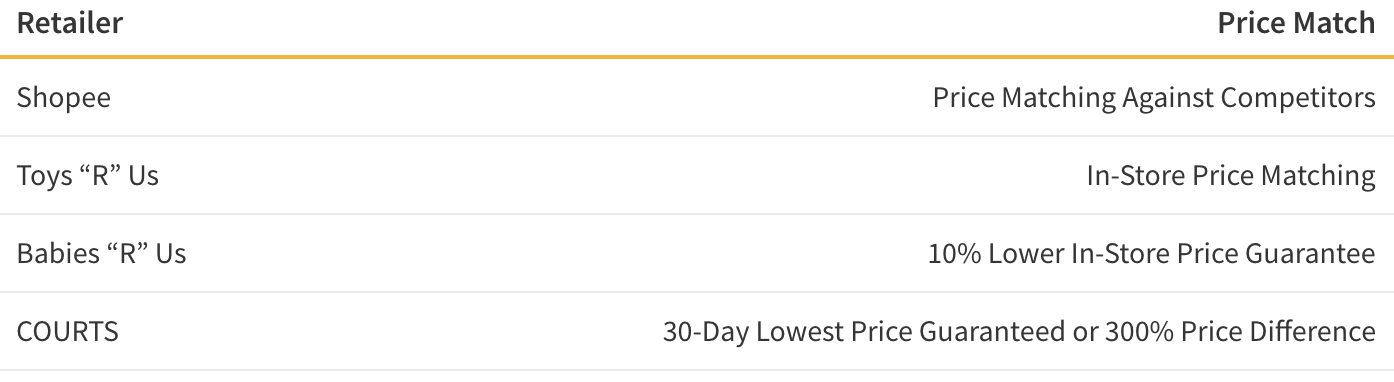

Once you've created your budget and spending limit, you'll want to find the best available deals for the gifts that you plan to purchase. Many of us are adept at comparing prices while shopping online. Some retailers make this even more convenient for shoppers with price matching programs. For example, stores such as Shopee, Toys “R” Us, Babies “R” Us and COURTS, among others, all provide some type of price guarantee. This ensures that you're getting the best possible price by either matching their competitor's price or giving you a refund following your pruchase. Furthermore, some retailers will even beat their competitors pricing by 5% to 10%, helping you save even more if you happen to find another seller with a lower price. Therefore, it's very critical to do some quick research online to compare prices and read about price matching programs of particular retailers that offer items on your list.

Be a Savvy Credit Card User

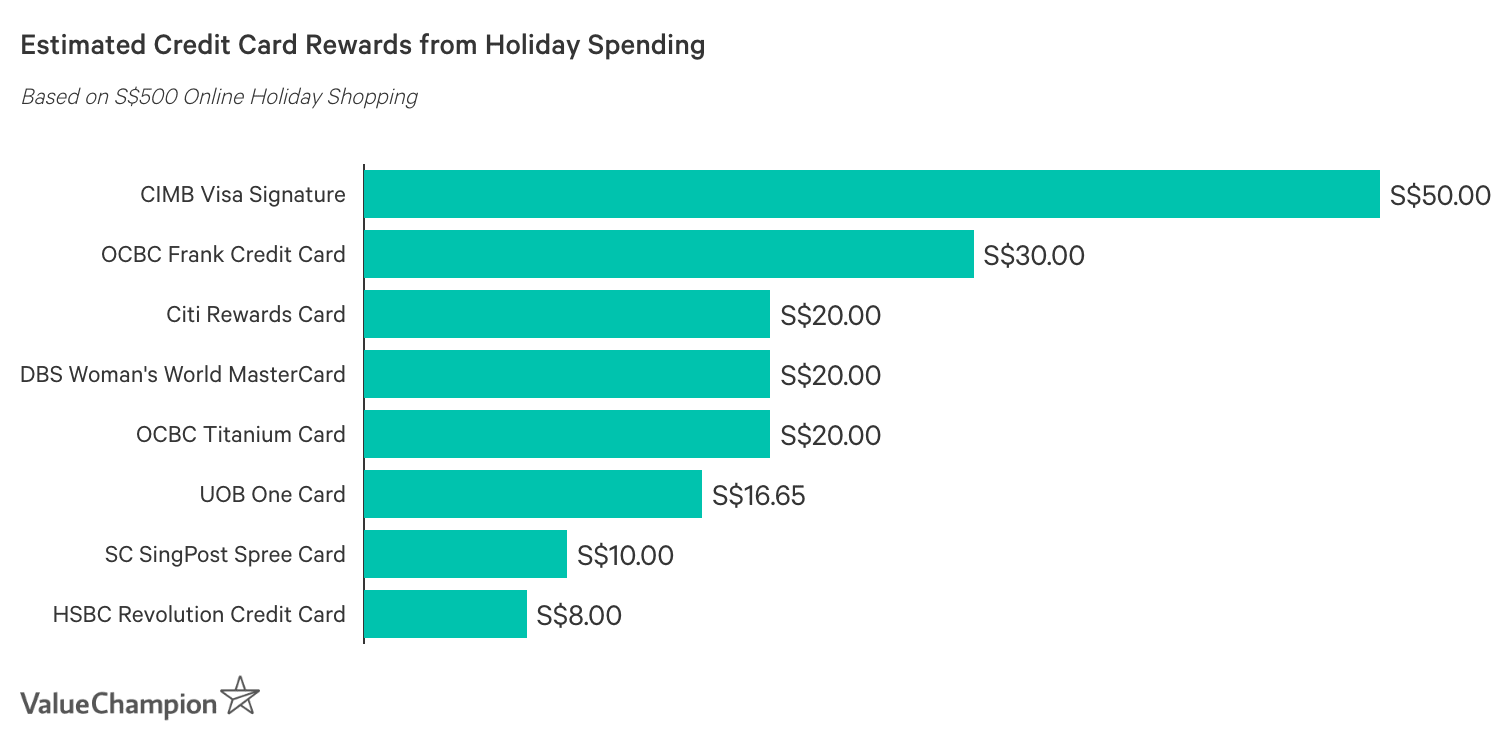

Whether you plan to do your shopping online or in-person, you'll want to make sure that you're optimising your credit card usage. For example, some individuals with long holiday shopping lists would be able to accrue significant travel rewards or cashback just by using the right credit card. This could help you begin saving towards a future trip or decrease the cost of your total shopping bill.

While it is possible to rack up rewards by optimising your credit card use, it is important to avoid credit card behavior that will actually end up costing you a significant amount of money. First, you should not purchase so many gifts that you are unable to make on-time payments. Making late payments may hurt your credit score, increase your interest rate and result in late fees of S$20 to S$60. Additionally, if you do not completely repay your credit card bill each month, you will quickly accrue credit card debt as cards tend to charge annual interest rates of about 25%, though there are exceptions.

How to Manage Existing Credit Card Debt

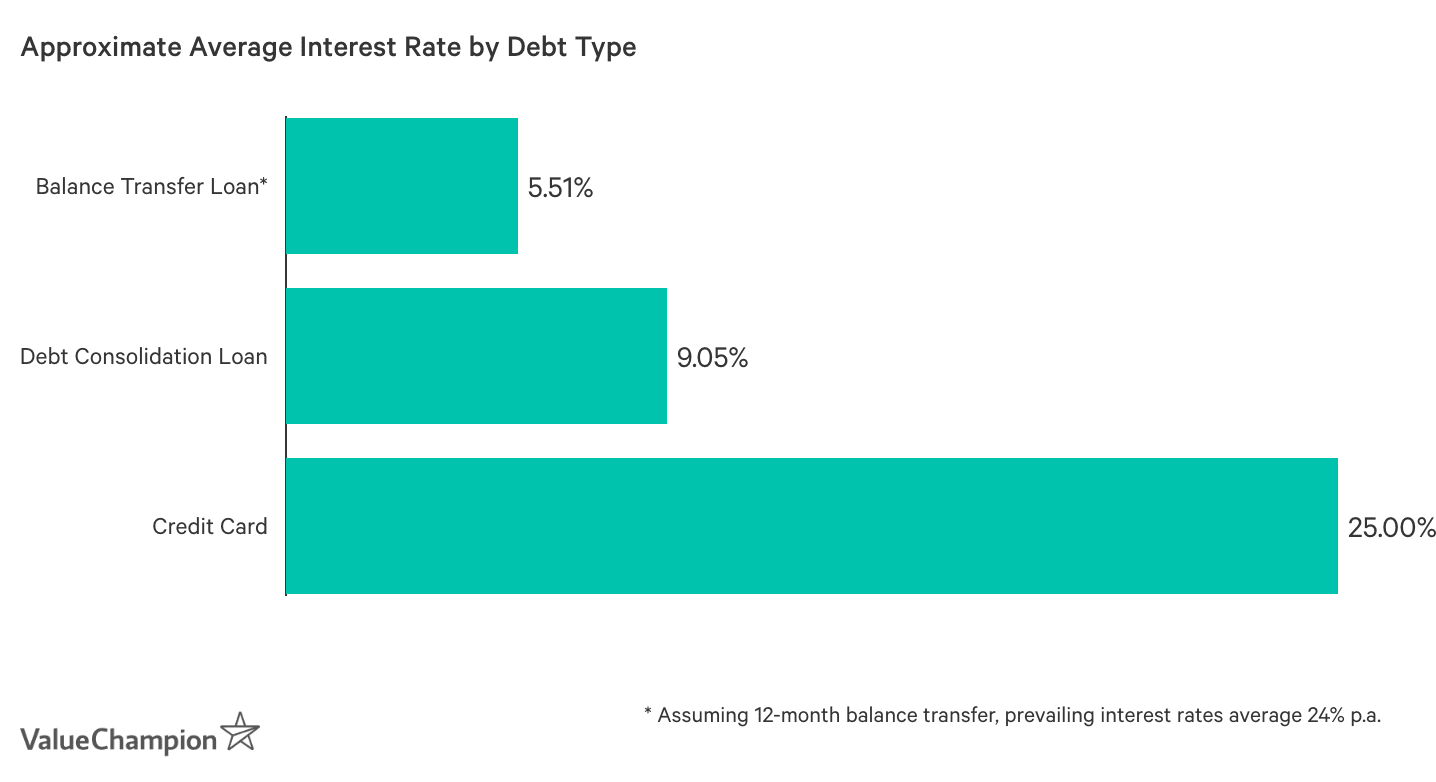

If you do have a significant amount of credit card debt, holiday shopping can be an extra stressful affair. For some this may be an incentive to get their finances in order. While we do not recommend taking on debt to finance holiday shopping, there are loan products available that may help you decrease your debt burden and make the holidays more relaxing. These loans can also be very helpful for those who end up with a financial hangover in January after their holiday spending spree.

For example, balance transfer loans can be a great way to manage credit card debt, especially when you will be able to repay this debt within a year and a half. This is because balance transfers allow borrowers to transfer their personal debt to a new loan that comes with an interest-free period of 3 to 18 months. On the other hand, borrowers that may require a longer period of time to pay down their debt may prefer a debt consolidation loan. These loans do not offer an interest-free period, but charge much lower interest rates than balance transfers following their interest free periods, allowing borrowers to spread out their debt obligations over a long period of time.